Sallie Mae 2005 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.96

Liquidity Risk (See also “LIQUIDITY AND CAPITAL RESOURCES—Securitization Activities—

Liquidity Risk and Funding—Long-Term”)

Credit Risk

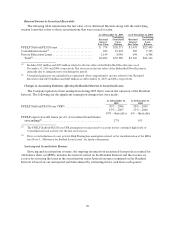

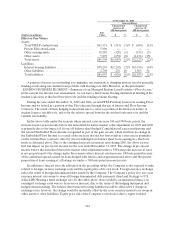

We bear the full risk of borrower and closed school losses experienced in our Private Education Loan

portfolio. These loans are underwritten and priced according to risk, generally determined by a

commercially available consumer credit scoring system, FICO(TM). Because of the nature of our lending,

after an initial decrease, borrower FICO scores will generally improve over time. Additionally, for

borrowers who do not meet our lending requirements or who desire more favorable terms, we require

credit-worthy co-borrowers. Our higher education Private Education Loans are not dischargeable in

bankruptcy, except in certain limited circumstances.

We have defined underwriting and collection policies, and ongoing risk monitoring and review

processes for all Private Education Loans. Potential credit losses are considered in our risk-based pricing

model. The performance of the Private Education Loan portfolio may be affected by the economy, and a

prolonged economic downturn may have an adverse effect on its credit performance. Management believes

that it has provided sufficient allowances to cover the losses that may be experienced in both the federally

guaranteed and Private Education Loan portfolios over the next two years depending on the portfolio. In

addition, when a school closes, losses may be incurred for student borrowers who have not completed their

education and in certain states are not required to repay their student loans. We have provided for these

potential losses in our allowance for loan losses. There is, however, no guarantee that such allowances are

sufficient enough to account for actual losses. (See “LENDING BUSINESS SEGMENT—Private

Education Loans—Activity in the Allowance for Private Education Loan Losses.”)

We have credit risk exposure to the various counterparties with whom we have entered into derivative

contracts. We review the credit standing of these companies. Our credit policies place limits on the amount

of exposure we may take with any one party and in most cases, require collateral to secure the position.

The credit risk associated with derivatives is measured based on the replacement cost should the

counterparties with contracts in a gain position to the Company fail to perform under the terms of the

contract. We also have credit risk with two commercial airlines related to our portfolio of leveraged leases.

(See “LENDING BUSINESS SEGMENT—Other Income, Net.”)

Consolidation Loan Refinancing Risk

The consolidation of our loan portfolio can have detrimental effects. First, we may lose student loans

in our portfolio that are consolidated with other lenders. In 2005, we experienced a net decrease of $26

million of student loans from Consolidation Loan activity as more of our FFELP student loans were

consolidated with other lenders than were consolidated by us. This was primarily caused by the run-off of

Consolidation Loans through the reconsolidation through the Direct Lending Program, as discussed in

“LENDING SEGMENT—Consolidation Loan Activity.” Absent reconsolidation, we would have had a net

increase in student loans from consolidation for the second year in a row. Second, Consolidation Loans

have lower net yields than the FFELP Stafford loans they replace. This is somewhat offset by the longer

average lives of Consolidation Loans. Third, we must maintain sufficient, short-term liquidity to enable us

to cost-effectively refinance previously securitized FFELP loans as they are consolidated back on to our

balance sheet.

See also the discussion of the effects of reconsolidation on the Consolidation Loan portfolio at

“LENDING BUSINESS SEGMENT—Consolidation Loan Activity” and its effect on our Floor Income

Contracts economically hedging Consolidation Loans at “LENDING BUSINESS SEGMENT—Summary

of our Managed Student Loan Portfolio—Student Loan Floor Income Contracts.”