Sallie Mae 2005 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-40

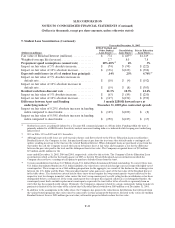

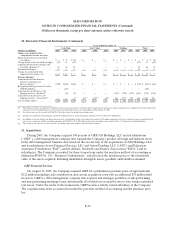

9. Student Loan Securitization (Continued)

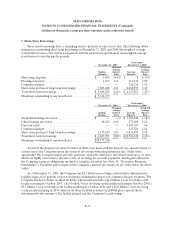

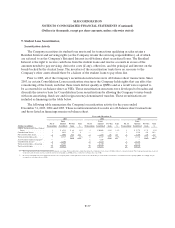

For the years ended December 31, 2005, 2004 and 2003 the Company recorded impairment charges to

the Retained Interests of $260 million, $80 million and $96 million, respectively. The impairment charge in

2005 was primarily caused by the record levels of consolidation activity as well as the Company increasing

its expected future CPR assumptions used to value the Residual Interest as of September 30, 2005. This

surge in Consolidation Loan activity was due to FFELP Stafford borrowers locking in lower interest rates

by consolidating their loans prior to the July 1 interest rate reset for FFELP Stafford loans. These

applications were processed through the Company’s securitizations in both the third and fourth quarter of

2005. The level and timing of Consolidation Loan activity is highly volatile, and in response the Company

continues to revise its estimates of the effects of Consolidation Loan activity on its Retained Interests.

Additional impairment may be recorded in future periods if Consolidation Loan activity remains higher

than projected. The 2005 impairment charge was also due to the re-introduction of a one percent Risk

Sharing loss assumption in the Company’s FFELP residuals related to the reauthorization of the Higher

Education Act. (See “OTHER RELATED EVENTS AND INFORMATION—Reauthorization” for a

full update of the HEA.) This comprised $23 million of the total impairment charge for 2005. See

“Allowance for FFELP Student Loans” for further discussion regarding the change in the Risk Sharing

exposure.

The impairment charge for 2004 is primarily the result of (a) FFELP Stafford loans consolidating at

levels faster than projected resulting in $47 million of impairment and (b) rising interest rates during the

second quarter 2004 which decreased the value of the Floor Income component of the Company’s

Retained Interest resulting in $33 million of impairment. Impairment for 2003 was primarily due to

FFELP Stafford loans prepaying faster than projected. These impairment charges were recorded as a loss

and included as a reduction to securitization revenue.

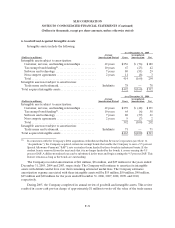

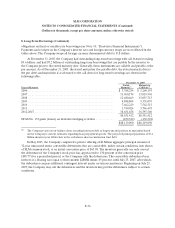

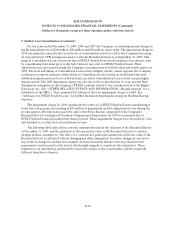

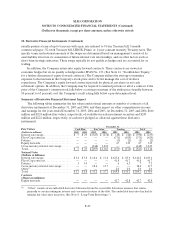

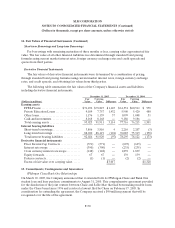

The following table reflects key economic assumptions used in the valuation of the Retained Interest

at December 31, 2005, and the sensitivity of the current fair value of the Retained Interests to adverse

changes in those assumptions. The effect of a variation in a particular assumption on the fair value of the

Retained Interest is calculated without changing any other assumption. In reality, changes in one factor

may result in changes in another (for example, increases in market interest rates may result in lower

prepayments and increased credit losses), which might magnify or counteract the sensitivities. These

sensitivities are hypothetical and should be used with caution, as the actual results could be materially

different than these estimates.