Sallie Mae 2005 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.105

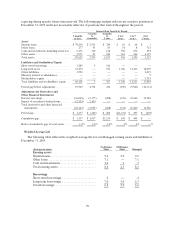

contracts used in the Company’s share repurchase program. A hypothetical decrease in the Company’s

stock price per share of $5.00 and $10.00 would decrease “unrealized gains (losses) on derivative and

hedging activities” by $213 million and $426 million, respectively. In addition to the net income impact,

other assets would decrease by the aforementioned amounts. Stock price decreases can also result in the

counterparty exercising its right to demand early settlement on a portion of or the total contract depending

on trigger prices set in each contract. With the $5.00 and $10.00 decrease in unit stock price above, none of

these triggers would be met and no counterparty would have the right to early settlement.

Item 8. Financial Statements and Supplementary Data

Reference is made to the financial statements listed under the heading “(a)1.A. Financial Statements”

of Item 15 hereof, which financial statements are incorporated by reference in response to this Item 8.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

Nothing to report.

Item 9A. Controls and Procedures

Disclosure Controls and Procedures

Our management, with the participation of our Chief Executive Officer and Chief Financial Officer,

evaluated the effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) and

15d-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of

December 31, 2005. Based on this evaluation, our Chief Executive Officer and Chief Financial Officer

concluded that, as of December 31, 2005, our disclosure controls and procedures were effective to ensure

that information required to be disclosed by us in the reports that we file or submit under the Exchange

Act is (a) recorded, processed, summarized and reported within the time periods specified in the SEC’s

rules and forms and (b) accumulated and communicated to our management, including our Chief

Executive Officer and Chief Financial Officer as appropriate to allow timely decisions regarding required

disclosure.

Changes in Internal Control Over Financial Reporting

No change in our internal control over financial reporting (as defined in Rules 13a-15(f) and

15d-15(f) under the Securities Exchange Act of 1934, as amended) occurred during the fiscal quarter

ended December 31, 2005 that has materially affected, or is reasonably likely to materially affect, our

internal control over financial reporting.

Item 9B. Other Information

Nothing to report.