Sallie Mae 2005 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214

|

|

103

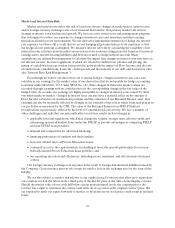

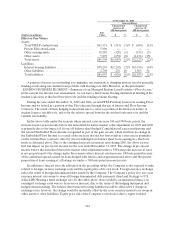

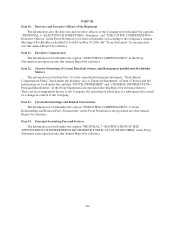

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Interest Rate Sensitivity Analysis

The effect of short-term movements in interest rates on our results of operations and financial

position has been limited through our interest rate risk management. The following tables summarize the

effect on earnings for the years ended December 31, 2005 and 2004 and the effect on fair values at

December 31, 2005 and 2004, based upon a sensitivity analysis performed by management assuming a

hypothetical increase in market interest rates of 100 basis points and 300 basis points while funding spreads

remain constant.

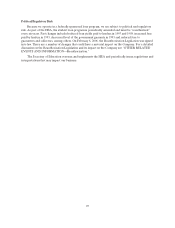

Year ended December 31, 2005 Year ended December 31, 2004

Interest Rates: Interest Rates:

Change from

increase of

100 basis

points

Change from

increase of

300 basis

points

Change from

increase of

100 basis

points

Change from

increase of

300 basis

points

(Dollars in millions,

except per share amounts) $ % $ % $ % $ %

Effect on Earnings

Increase/(decrease) in pre-tax net income

before unrealized gains (losses) on

derivative and hedging activities ......... $ 12 1% $ 14 1% $ 31 3 % $138 14%

Unrealized gains (losses) on derivative and

hedging activities..................... 202 32 347 55 279 18 576 37

Increase in net income before taxes ........ $ 214 10% $ 361 17% $ 310 12 % $ 714 28%

Increase in diluted earnings per share ...... $ .323 11% $ .580 19% $ .424 10 % $ .975 24%

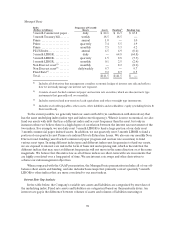

At December 31, 2005

Interest Rates:

Change from

increase of

100 basis points

Change from

increase of

300 basis points

(Dollars in millions)

Fair

Value $ % $ %

Effect on Fair Values

Assets

Total FFELPstudent loans........................ $ 76,492 $ (215) —% $ (385) (1)%

Private Education Loans.......................... 9,189 — — — —

Other earning assets.............................. 9,344 (57) (1) (164) (2)

Otherassets..................................... 7,429 (292) (4) (377) (5)

Totalassets...................................... $102,454 $ (564) (1)% $ (926) (1)%

Liabilities

Interest bearing liabilities ......................... $ 92,026 $(1,437) (2)% $(3,612) (4)%

Otherliabilities.................................. 3,609 975 27 2,863 79

Totalliabilities................................... $ 95,635 $ (462) —% $ (749) (1)%