Sallie Mae 2005 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

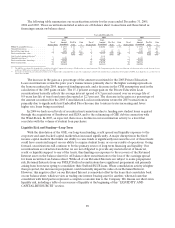

The impairment charge for 2004 is primarily the result of (a) FFELP Stafford loans consolidating at

levels faster than projected resulting in $47 million of impairment and (b) rising interest rates during the

second quarter 2004 which decreased the value of the Floor Income component of our Retained Interest

resulting in $33 million of impairment. Impairment for 2003 was primarily due to FFELP Stafford loans

prepaying faster than projected. These impairment charges are recorded as a loss and are included as a

reduction to securitization revenue.

We receive annual servicing fees of 90 basis points, 50 basis points and 70 basis points of the

outstanding securitized loan balance related to our FFELP Stafford/PLUS, Consolidation Loan and

Private Education Loan securitizations, respectively.

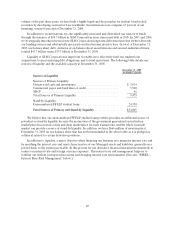

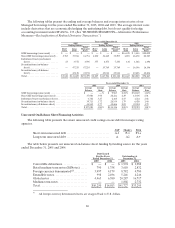

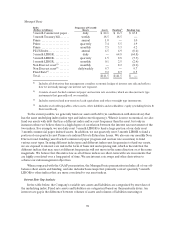

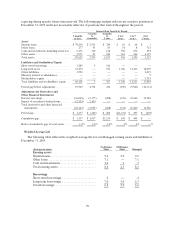

CONTRACTUAL CASH OBLIGATIONS

The following table provides a summary of our obligations associated with long-term notes and equity

forward contracts at December 31, 2005. For further discussion of these obligations, see Note 8, “Long-

Term Debt,” Note 10, “Derivative Financial Instruments,” and Note 14, “Stockholders’ Equity,” to the

consolidated financial statements.

1 Year

or less

2 to 3

Years

4 to 5

Years

Over

5 Years Total

Long-term notes(1)(2) ............................. $3,388 $26,441 $ 16,351 $ 42,371 $ 88,551

Equity forward contracts(3)........................ — 693 1,643 — 2,336

Total contractual cashobligations................. $3,388 $27,134 $ 17,994 $ 42,371 $ 90,887

(1) Excludes SFAS No. 133 derivative market value adjustment reductions of $432 million for long-term notes; only

includes principal obligations, does not include interest on the debt obligations or on our interest rate swaps.

(2) Includes FIN No. 46 long-term beneficial interests of $47.2 billion of notes issued by consolidated variable

interest entities in conjunction with our on-balance sheet securitization transactions and included in long-term

notes in the consolidated balance sheet.

(3) Our obligation to repurchase shares under equity forward contracts is calculated using the average purchase

prices for outstanding contracts in the year the contracts expire. At or prior to the maturity date of the

agreements, we can purchase shares at the contracted amount plus or minus an early break fee, or we can settle

the contract on a net basis with either cash or shares. If our stock price declines to certain levels, the third parties

with whom we entered into the contracts can liquidate their positions prior to the maturity date.

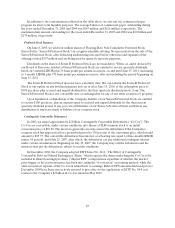

OFF-BALANCE SHEET LENDING ARRANGEMENTS

The following table summarizes the commitments associated with student loan purchases and

contractual amounts related to off-balance sheet lending related financial instruments and guarantees at

December 31, 2005.

1 Year

or less

2 to 3

Years

4 to 5

Years

Over

5 Years Total

Student loan purchases(1),(2) ........................ $11,297 $35,304 $ 3,876 $ 225 $ 50,702

Lines of credit(2) .................................. 75 1,161 153 100 1,489

$ 11,372 $ 36,465 $ 4,029 $ 325 $ 52,191

(1) Includes amounts committed at specified dates under forward contracts to purchase student loans and anticipated

future requirements to acquire student loans from lending partners (discussed below) estimated based on future

volumes at contractually committed rates. These commitments are not accounted for as derivatives under SFAS

No. 133 as they do not meet the definition of a derivative due to the lack of a fixed and determinable purchase

amount.

(2) Expiration of commitments and guarantees reflect the earlier of call date or maturity date as of December 31,

2005.