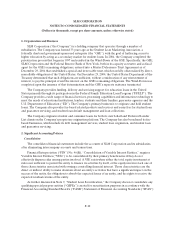

Sallie Mae 2005 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

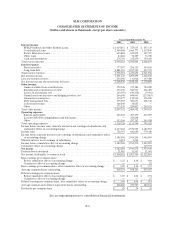

F-7

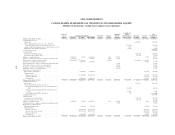

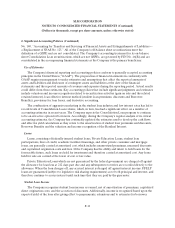

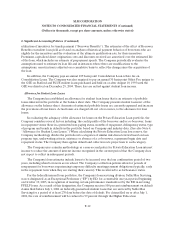

SLM CORPORATION

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Dollars in thousands, except share and per share amounts)

Accumulated

Preferred Additional Other Total

Stock Common Stock Shares Preferred Common Paid-In Comprehensive Retained Treasury Stockholders’

Shares Issued Treasury Outstanding Stock Stock Capital Income (Loss) Earnings Stock Equity

Balance at December 31, 2002 ...................... 3,300,000 624,551,508 (166,812,720) 457,738,788 $ 165,000 $ 124,910 $ 1,102,574 $ 592,760 $ 2,718,226 $ (2,705,520) $ 1,997,950

Comprehensive income:

Netincome................................. 1,533,560 1,533,560

Other comprehensive income, net of tax: Change in

unrealized gains(losses) on investments, net of tax..... (172,897) (172,897)

Change in unrealized gains (losses) on derivatives, net of tax 7,057 7,057

Minimum pension liability adjustment............... (1,299) (1,299)

Comprehensive income .......................... 1,366,421

Cash dividends:

Common stock ($.28 per share) ................... (266,881) (266,881)

Preferred stock ($3.48 per share) .................. (11,501) (11,501)

Issuance of common shares........................ 12,263,832 90,456 12,354,288 2,454 293,405 3,238 299,097

Issuance of common shares due to exercise of stock warrants . 5,827,656 5,827,656 1,165 39,034 40,199

Retirement of common stock in treasury ............... (

170,000,000) 170,000,000 — (34,000) (3,032,120) 3,066,120 —

Donationof common stock in treasury ................ 1,108,340 1,108,340 40,000 40,000

Tax benefit related to employee stock option and purchase plan . 57,632 57,632

Tax benefit related to exercise of stock warrants .......... 65,498 65,498

Premiums on equity forward purchase contracts .......... (17,361) (17,361)

Cumulative effect of accounting change................ 12,458 12,458

Repurchase of common shares:

Open market repurchases....................... (6,718,199) (6,718,199) (253,276) (253,276)

Equity forwards:

Exercise cost, cash........................... (

20,190,640) (20,190,640) (568,877) (568,877)

Gain on settlement.......................... (38,290) (38,290)

Benefit plans.............................. (

2,441,990) (2,441,990) (93,023) (93,023)

Balance at December 31, 2003 ...................... 3,300,000 472,642,996 (24,964,753) 447,678,243 $ 165,000 $ 94,529 $ 1,553,240 $ 425,621 $ 941,284 $ (549,628) $ 2,630,046

Comprehensive income:

Netincome................................. 1,913,270 1,913,270

Other comprehensive income, net of tax:

Change in unrealized gains (losses) on investments, net

of tax.................................. (42,849) (42,849)

Change in unrealized gains (losses) on derivatives, net

oftax.................................. 57,644 57,644

Minimum pension liability adjustment ............. 256 256

Comprehensive income .......................... 1,928,321

Cash dividends:

Common stock ($.74 per share) ................... (321,313) (321,313)

Preferred stock ($3.48 per share) .................. (11,501) (11,501)

Issuance of common shares........................ 10,623,412 61,810 10,685,222 2,125 293,614 2,449 298,188

Tax benefit related to employee stock option and purchase plan . 58,606 58,606

Repurchase of common shares:

Open market repurchases....................... (

563,500) (563,500) (21,554) (21,554)

Equity forwards:

Exercise cost, cash........................... (19,323,760) (19,323,760) (694,050) (694,050)

Exercise cost, net settlement.................... (

13,393,350) (13,393,350) (629,331) (629,331)

Gain on settlement.......................... — — (73,419) (73,419)

Benefit plans.............................. (1,450,466) (1,450,466) (61,689) (61,689)

Balance at December 31, 2004 ...................... 3,300,000 483,266,408 (59,634,019) 423,632,389 $ 165,000 $ 96,654 $ 1,905,460 $ 440,672 $ 2,521,740 $ (2,027,222) $ 3,102,304