Sallie Mae 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

PART II.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases

of Equity Securities

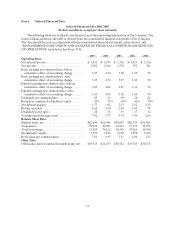

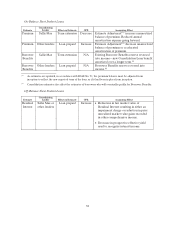

The Company’s common stock is listed and traded on the New York Stock Exchange under the

symbol SLM. The number of holders of record of the Company’s common stock as of March 3, 2006 was

603. The following table sets forth the high and low sales prices for the Company’s common stock for each

full quarterly period within the two most recent fiscal years.

Common Stock Prices

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

2005.................................... High $ 55.13 $ 51.46 $ 53.98 $ 56.48

Low 46.39 45.56 48.85 51.32

2004.................................... High $ 43.00 $ 42.49 $ 44.75 $ 54.44

Low 36.97 36.80 36.43 41.60

The Company paid quarterly cash dividends of $.17 per share on the common stock for the first

quarter of 2004, $.19 for the last three quarters of 2004 and for the first quarter of 2005, $.22 for the last

three quarters of 2005, and declared a quarterly cash dividend of $.22 for the first quarter of 2006.

In May 2003, the Company announced a three-for-one stock split of the Company’s common stock to

be effected in the form of a stock dividend. The additional shares were distributed on June 20, 2003 for all

shareholders of record on June 6, 2003. All share and per share amounts presented have been retroactively

restated for the stock split. Stockholders’ equity has been restated to give retroactive recognition to the

stock split for all periods presented, by reclassifying from additional paid-in capital to common stock, the

par value of the additional shares issued as a result of the stock split.

Issuer Purchases of Equity Securities

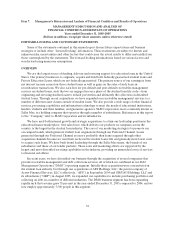

The following table summarizes the Company’s common share repurchases during 2005 pursuant to

the stock repurchase program (see Note 14 to the consolidated financial statements, “Stockholders’

Equity”) first authorized in September 1997 by the Board of Directors. Since the inception of the program,

which has no expiration date, the Board of Directors has authorized the purchase of up to 308 million

shares as of December 31, 2005.

(Common shares in millions)

Total Number

of Shares

Purchased(1) Average Price

Paid per Share

Total Number of

Shares Purchased

as Part of Publicly

Announced Plans

or Programs

Maximum Number

of Shares that May

Yet Be Purchased

Under the Plans

or Programs(2)

Period:

January 1—March 31, 2005.......... 3.4 $50.43 3.2 28.9

April 1—June 30,2005.............. 3.6 48.55 3.3 20.5

July1—September 30, 2005 ......... 3.4 50.12 2.9 19.0

October 1—October 31,2005........ 3.2 50.77 2.9 19.0

November 1—November 30, 2005.... 1.0 51.03 .8 19.0

December1—December 31, 2005.... 4.2 49.73 4.2 18.7

Total fourth quarter.............. 8.4 50.28 7.9

Year ended December 31,2005...... 18.8 $49.94 17.3

(1) The total number of shares purchased includes: i) shares purchased under the stock repurchase program

discussed above, and ii) shares purchased in connection with the exercise of stock options and vesting of

performance stock to satisfy minimum statutory tax withholding obligations and shares tendered by employees to

satisfy option exercise costs (which combined totaled 1.5 million shares for 2005).

(2) Reduced by outstanding equity forward contracts.