Sallie Mae 2005 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

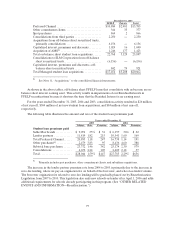

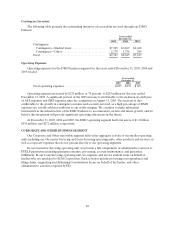

Operating Expenses

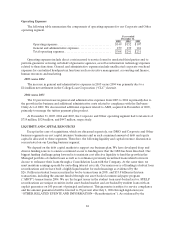

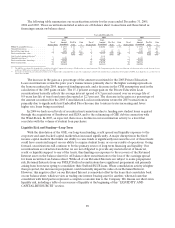

The following table summarizes the components of operating expenses for our Corporate and Other

operating segment.

Years ended

December 31,

2005 2004 2003

Operatingexpenses ...................................... $149 $152 $107

Generalandadministrativeexpenses....................... 159 139 124

Totaloperatingexpenses.................................. $308 $291 $231

Operating expenses include direct costs incurred to service loans for unrelated third parties and to

perform guarantor servicing on behalf of guarantor agencies, as well as information technology expenses

related to these functions. General and administrative expenses include unallocated corporate overhead

expenses for centralized headquarters functions such as executive management, accounting and finance,

human resources and marketing.

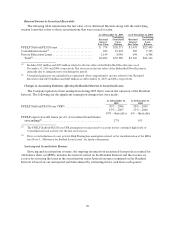

2005 versus 2004

The increase in general and administrative expenses in 2005 versus 2004 was primarily due to a

$14 million net settlement in the College Loan Corporation (“CLC”) lawsuit.

2004 versus 2003

The 12 percent increase in general and administrative expenses from 2003 to 2004 is primarily due to

the growth in the business and additional administrative costs related to compliance with the Sarbanes-

Oxley Act of 2002. We also incurred additional expenses related to AMS, acquired in December of 2003,

primarily to manage the tuition payment plan product.

At December 31, 2005, 2004 and 2003, the Corporate and Other operating segment had total assets of

$719 million, $524 million, and $447 million, respectively.

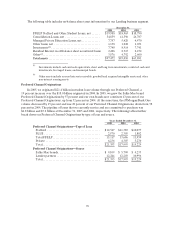

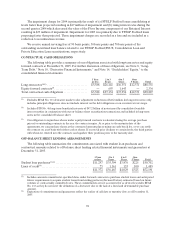

LIQUIDITY AND CAPITAL RESOURCES

Except in the case of acquisitions, which are discussed separately, our DMO and Corporate and Other

business segments are not capital intensive businesses and as such a minimal amount of debt and equity

capital is allocated to these segments. Therefore, the following liquidity and capital resource discussion is

concentrated on our Lending business segment.

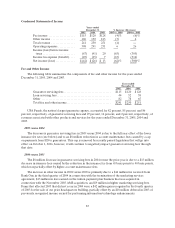

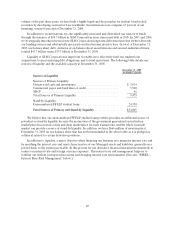

We depend on the debt capital markets to support our business plan. We have developed deep and

diverse funding sources to ensure continued access to funding now that the GSE has been dissolved. Our

biggest funding challenge going forward is to maintain cost effective liquidity to fund the growth in the

Managed portfolio of student loans as well as to refinance previously securitized loans when borrowers

choose to refinance their loans through a Consolidation Loan with the Company. At the same time, we

must maintain earnings spreads by controlling interest rate risk. Our main source of funding is student loan

securitizations and we have built a highly liquid market for such financings as evidenced by the

$26.1 billion in student loans securitized in twelve transactions in 2005, and $33.8 billion in thirteen

transactions, including the amount funded through our asset-backed commercial paper program

(“ABCP”) transaction in 2004. We are the largest issuer in the student loan asset-backed sector. FFELP

securitizations are unique securities in the asset-backed market and are backed by student loans with an

explicit guarantee on 100 percent of principal and interest. This guarantee is subject to service compliance

and the amount guaranteed will be lowered to 99 percent after July 1, 2006 through legislation (see

“OTHER RELATED EVENTS AND INFORMATION—Reauthorization”). As evidenced by the