Sallie Mae 2005 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-37

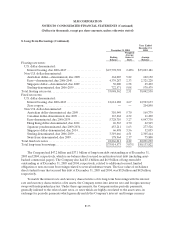

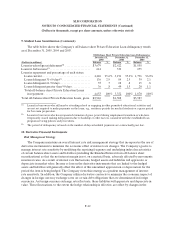

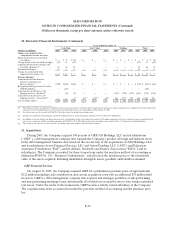

9. Student Loan Securitization

Securitization Activity

The Company securitizes its student loan assets and for transactions qualifying as sales retains a

Residual Interest and servicing rights (as the Company retains the servicing responsibilities), all of which

are referred to as the Company’s Retained Interest in off-balance sheet securitized loans. The Residual

Interest is the right to receive cash flows from the student loans and reserve accounts in excess of the

amounts needed to pay servicing, derivative costs (if any), other fees, and the principal and interest on the

bonds backed by the student loans. The investors of the securitization trusts have no recourse to the

Company’s other assets should there be a failure of the student loans to pay when due.

Prior to 2003, all of the Company’s securitization structures were off-balance sheet transactions. Since

2003, in certain Consolidation Loan securitization structures the Company holds rights that can affect the

remarketing of the bonds, such that these trusts did not qualify as QSPEs and as a result were required to

be accounted for on-balance sheet as VIEs. These securitization structures were developed to broaden and

diversify the investor base for Consolidation Loan securitizations by allowing the Company to issue bonds

with non-amortizing, fixed rate and foreign currency denominated tranches. These securitizations are

included as financings in the table below.

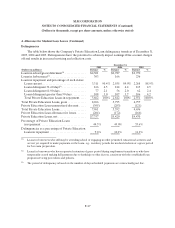

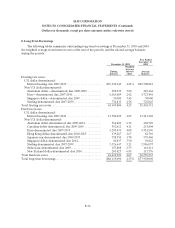

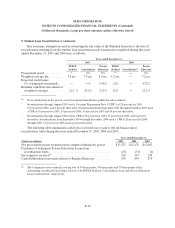

The following table summarizes the Company’s securitization activity for the years ended

December 31, 2005, 2004 and 2003. Those securitizations listed as sales are off-balance sheet transactions

and those listed as financings remain on balance sheet.

Years ended December 31,

2005 2004 2003

(Dollars in millions)

No. of

Transactions

Loan

Amount

Securitized

Pre-Tax

Gain

Gain

%

No. of

Transactions

Loan

Amount

Securitized

Pre-Tax

Gain

Gain

%

No. of

Transactions

Loan

Amount

Securitized

Pre-Tax

Gain

Gain

%

FFELP Stafford and Other Student

Loans .................. 3 $ 6,533 $ 68 1.1% 4 $ 10,002 $ 134 1.3% 4 $ 5,772 $ 73 1.3%

Consolidation Loans .......... 2 4,011 31 .8 — — — — 2 4,256 433 10.2

Private Education Loans........ 2 3,005 453 15.1 2 2,535 241 9.5 3 3,503 238 6.8

Total securitizations-sales....... 7 13,549 $ 552 4.1% 6 12,537 $ 375 3.0% 9 13,531 $ 744 5.5%

Asset-backed commercial paper(1). . — — 1 4,186 — —

Consolidation Loans(2) ......... 5 12,503 6 17,124 7 16,592

Total securitizations—financings . . 5 12,503 7 21,310 7 16,592

Total securitizations........... 12 $ 26,052 13 $ 33,847 16 $ 30,123

(1) The Company’s asset backed commercial paper program is a revolving 364-day multi seller conduit that allows the Company to borrow up to $5 billion subject to annual extensions. The Company may purchase loans out

of this trust at its discretion and as a result, the trust does not qualify as a QSPE and is accounted for on balance sheet as a VIE.

(2) In certain Consolidation Loan securitization structures, the Company holds certain rights that can affect the remarketing of certain bonds, such that these securitizations did not qualify QSPEs. Accordingly, they are

accounted for on balance sheet as VIEs.