Sallie Mae 2005 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

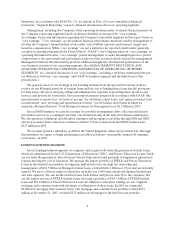

Student Lending Marketplace

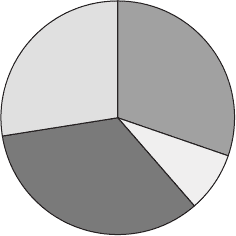

The following chart shows the estimated sources of funding for attending two-year and four-year

colleges for the academic year (“AY”) ended June 30, 2006 (AY 2005-2006). Approximately 39 percent of

the funding comes from federally guaranteed student loans and Private Education Loans. The

parent/student contribution comes from savings/investments, current period earnings and other loans

obtained without going through the normal financial aid process.

Sources of Funding for College Attendance – AY 2005-2006(1)

Total Projected Cost – $222 Billion

(dollars in billions)

Parent/Student

Contributions

Private Education

Loans

Other

Federally

Guaranteed Student

Loans

(includes scholarships, grants, tax

relief, and other aid from states,

colleges, employers and other

sources)

$67

$19

$75

$61

(1) Source: Based on estimates by Octameron Associates, “Don’t Miss Out,” 29th Edition, by College Board, “2005

Trends in Student Aid” and Sallie Mae. Includes tuition, room, board, transportation and miscellaneous costs for two

and four year college degree-granting programs.

Federally Guaranteed Student Lending Programs

There are two competing programs that provide student loans where the ultimate credit risk lies with

the federal government: the FFELP and the Federal Direct Lending Program (“FDLP”). FFELP loans are

provided by private sector institutions and are ultimately guaranteed by ED. FDLP loans are funded by

taxpayers and provided to borrowers directly by ED on terms similar to student loans in the FFELP. In

addition to these government guaranteed programs, Private Education Loans are made by financial

institutions where the lender assumes the credit risk of the borrower.

For the federal fiscal year (“FFY”) ended September 30, 2005 (FFY 2005), ED estimated that the

FFELP’s market share in federally guaranteed student loans was 77 percent, up from 75 percent in FFY

2004. (See “LENDING BUSINESS SEGMENT—Competition.”) Total FFELP and FDLP volume for

FFY 2005 grew by nine percent, with the FFELP portion growing 10 percent. Based on current industry

trends, management expects the federal student loan market growth will continue in low double digits over

the next three years.

The Higher Education Act (the “HEA”) includes regulations that cover every aspect of the servicing

of a federally guaranteed student loan, including communications with borrowers, loan originations and

default aversion. Failure to service a student loan properly could jeopardize the guarantee on federal

student loans. This guarantee generally covers 98 and 97 percent of the student loan’s principal and

accrued interest for loans disbursed before and after July 1, 2006, respectively, except in the case of death,

disability, or bankruptcy of the borrower, in which case, the guarantee covers 100 percent of the student

loan’s principal and accrued interest. In addition, when an eligible lender or lender servicer (as agent for