Sallie Mae 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

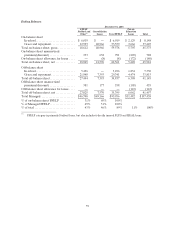

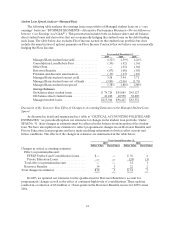

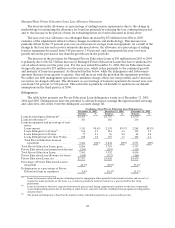

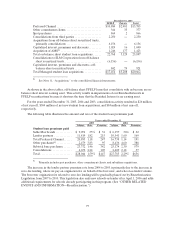

The following table summarizes changes in the allowance for Private Education Loan losses for the

years ended December 31, 2005, 2004 and 2003.

Activity in Allowance for Private Education Loans

On-Balance Sheet Off-Balance Sheet Managed Basis

Years ended Years ended Years ended

Dec. 31,

2005

Dec. 31,

2004

Dec. 31,

2003

Dec. 31,

2005

Dec. 31,

2004

Dec. 31,

2003

Dec. 31,

2005

Dec. 31,

2004

Dec. 31,

2003

Allowance at beginning of period. $ 172 $ 166 $ 181 $ 143 $ 93 $ 13 $ 315 $ 259 $ 194

Provision for Private Education

Loan losses............. 186 130 107 3 28 10 189 158 117

Changeinlossestimate...... 40 — — (60) — — (20) — —

Change in recovery estimate. . . (49) — — (16) — — (65) — —

Total provision............ 177 130 107 (73) 28 10 104 158 117

Other................... — — 21 — — (1) — — 20

Charge-offs............... (154 ) (110) (83) (2) (6) — (156 ) (116 ) (83)

Recoveries ............... 19 14 11 — — — 19 14 11

Net charge-offs ............ (135 ) (96) (72) (2) (6) — (137 ) (102 ) (72)

Balance before securitization of

Private Education Loans .... 214 200 237 68 115 22 282 315 259

Securitization of Private Education

Loans .................. (10) (28) (71) 10 28 71 — — —

Allowance atend of period..... $ 204 $ 172 $ 166 $ 78 $ 143 $ 93 $ 282 $ 315 $ 259

Net charge-offs as a percentage of

average loans in repayment

(annualized) ............. 4.14% 3.57% 2.59% .07% .22% —% 1.89% 1.92 % 1.85%

Allowance as a percentage of the

ending total loan balance .... 2.56 % 3.07% 3.57% .89% 2.31% 2.37% 1.69 % 2.67 % 3.02%

Allowance as a percentage of

ending loans in repayment . . . 5.57 % 6.05% 6.50% 1.68% 4.27% 4.99% 3.40 % 5.08 % 5.86%

Average coverage of net

charge-offs(annualized)..... 1.52 1.79 2.30 29.75 24.81 — 2.06 3.09 3.60

Average total loans ........... $6,922 $ 4,795 $ 5,018 $ 7,238 $ 5,495 $ 2,284 $ 14,160 $ 10,290 $ 7,303

Ending total loans............ $7,961 $ 5,592 $ 4,636 $ 8,758 $ 6,205 $ 3,928 $ 16,719 $ 11,797 $ 8,564

Average loans in repayment..... $3,252 $ 2,697 $ 2,772 $ 4,002 $ 2,611 $ 1,116 $ 7,254 $ 5,307 $ 3,888

Ending loans in repayment ..... $3,662 $ 2,842 $ 2,551 $ 4,653 $ 3,352 $ 1,870 $ 8,315 $ 6,194 $ 4,421

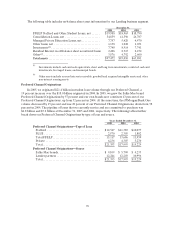

On-Balance Sheet versus Managed Presentation

All Private Education Loans are initially acquired on-balance sheet. When we securitize Private

Education Loans, we no longer legally own the loans and they are accounted for off-balance sheet. For our

Managed presentation in the table above, we reduce the on-balance sheet allowance for amounts

previously provided and then provide for these loans in the off-balance sheet section with the total of both

on and off-balance sheet residing in the Managed presentation.

When Private Education Loans in the majority of our securitized trusts become 180 days delinquent,

we typically exercise our contingent call option to repurchase these loans at par value out of the trust and

record a loss for the difference in the par value paid and the fair market value of the loan at the time of

purchase. If these loans reach the 212-day delinquency, a charge-off for the remaining balance of the loan

is triggered. On a Managed Basis, the losses recorded under GAAP for loans repurchased at day 180 are

reversed and the full amount is charged-off at day 212.

The off-balance sheet allowance is increasing as more loans are securitized but is lower than the on-

balance sheet percentage when measured as a percentage of ending loans in repayment because of the

different mix of loans on-balance sheet and off-balance sheet, as described above. Additionally, a larger

percentage of the off-balance sheet loan borrowers are still in-school status and not required to make

payments on their loans. Once repayment begins, the allowance requirements increase to reflect the

increased risk of loss as loans enter repayment.