Sallie Mae 2005 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

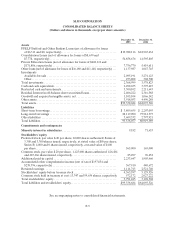

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-11

2. Significant Accounting Policies (Continued)

No. 140, “Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities—

a Replacement of SFAS No. 125.” All of the Company’s off-balance sheet securitizations meet the

definition of a QSPE and are not consolidated. The Company’s accounting treatment for its on-balance

sheet Consolidation Loan securitizations, which are not QSPEs, are governed by FIN No. 46(R) and are

consolidated in the accompanying financial statements as the Company is the primary beneficiary.

Use of Estimates

The Company’s financial reporting and accounting policies conform to generally accepted accounting

principles in the United States (“GAAP”). The preparation of financial statements in conformity with

GAAP requires management to make estimates and assumptions that affect the reported amounts of

assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the reporting period. Actual results

could differ from those estimates. Key accounting policies that include significant judgments and estimates

include valuation and income recognition related to securitization activities (gain on sale and the related

retained interest), loan effective interest method (student loan premiums, discounts and Borrower

Benefits), provisions for loan losses, and derivative accounting.

The combination of aggressive marketing in the student loan industry and low interest rates has led to

record levels of Consolidation Loan volume, which, in turn, has had a significant effect on a number of

accounting estimates in recent years. The Company expects the Consolidation Loan program to continue

to be an attractive option for borrowers. Accordingly, during the Company’s regular analysis of its critical

accounting estimates, the Company has continually updated the estimates used to develop the cash flows

and effective yield calculations as they relate to the amortization of student loan premiums and discounts,

Borrower Benefits and the valuation and income recognition of the Residual Interest.

Loans

Loans, consisting of federally insured student loans, Private Education Loans, student loan

participations, lines of credit, academic facilities financings, and other private consumer and mortgage

loans, are generally carried at amortized cost, which includes unamortized premiums, unearned discounts

and capitalized origination costs and fees. If the Company has the ability and intent to hold loans for the

foreseeable future, such loans are held for investment and therefore carried at amortized cost. Any loans

held for sale are carried at the lower of cost or fair value.

Private Education Loans which are not guaranteed by the federal government are charged off against

the allowance for loan loss at 212 days past due and any subsequent recoveries are recorded directly to the

allowance. When the loan charges off, any accrued interest is charged off against interest income. FFELP

loans are guaranteed (subject to legislative risk sharing requirements) as to both principal and interest, and

therefore continue to accrue interest until such time that they are paid by the guarantor.

Student Loan Income

The Company recognizes student loan income as earned, net of amortization of premiums, capitalized

direct origination costs, and the accretion of discounts. Additionally, income is recognized based upon the

expected yield of the loan after giving effect to prepayments, extensions and to estimates for borrower