Sallie Mae 2005 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-48

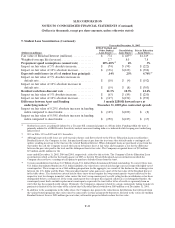

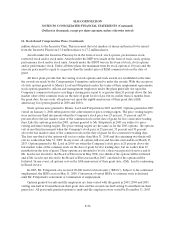

11. Acquisitions (Continued)

Goodwill resulting from these transactions reflects the benefits the Company expects to derive from

AFS’s experienced management team, existing servicing platform and several new asset classes in a new

line of business. It also reflects the benefits from the combined operations of AFS and the Company’s

existing DMO business segment. Goodwill will be reviewed for impairment in accordance with SFAS

No.142, as discussed further in Note 2, “Significant Accounting Policies.”

Identifiable intangible assets at each respective acquisition date includes AFS’s trade name, an

indefinite life intangible asset with an aggregate fair value of approximately $13 million as of the

acquisition dates, and definite life intangible assets with aggregate fair values of approximately $19 million

as of the acquisition dates, $15 million of which is attributed to customer relationships.

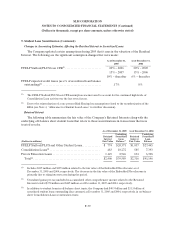

Southwest Student Services Corporation

On October 15, 2004, the Company purchased all of the outstanding stock of Southwest Student

Services Corporation (“Southwest”) from the Helios Education Foundation for total consideration of

approximately $533 million including cash of $525 million and restricted stock of $8 million, the exercise of

which is contingent on the combined company’s achievement of specified loan origination volumes.

Southwest provides for the origination, funding, acquisition and servicing of education loans. Southwest

provides student loans and related services nationally with a primary focus on colleges and universities in

Arizona and Florida.

The results of operations of Southwest have been included in the Company’s consolidated financial

statements since the acquisition date and are reflected within the Company’s lending segment results as

discussed further in Note 18, “Segment Reporting.” The acquisition and Southwest’s pro forma results of

operations prior to the acquisition date were deemed immaterial to the Company’s consolidated financial

statements.

The Company finalized its purchase price allocation in 2005 allocating the purchase price to the fair

values of the acquired intangible assets, liabilities and identifiable intangible assets as of the acquisition

date as determined by an independent appraiser. The final purchase price allocation resulted in an excess

purchase price over the fair value of net assets acquired, or goodwill, of approximately $185 million.

Goodwill will be reviewed for impairment in accordance with SFAS No. 142 as discussed further in Note 2,

“Significant Accounting Policies.”

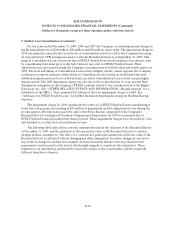

Education Assistance Foundation and Student Loan Finance Association

On July 1, 2005, the Company closed the second step in a two step purchase of the secondary market

and related businesses of EAF and SLFA and its subsidiaries for a purchase price of approximately

$61 million, increasing its purchase price to approximately $496 million.

The first step of the transaction closed on December 13, 2004, which included SLFA’s $1.8 billion

student loan portfolio (and the related funding). In addition, the Company entered into a full service

guarantor servicing contract with EAF’s affiliate, Northwest Education Association (“NELA”), a

guarantee agency for FFELP student loans that serves the Pacific Northwest and acquired all of the

outstanding voting common stock for a 66 percent equity interest and an option to purchase the remaining

equity within six to eight months in Washington Transferee Corporation (“WTC”), an indirect subsidiary