Sallie Mae 2005 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

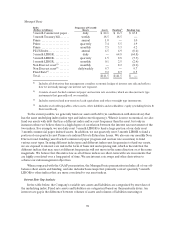

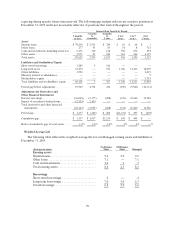

As of December 31, 2005, the expiration dates and range of and average purchase prices for

outstanding equity forward contracts were as follows:

Year of maturity

(Contracts in millions of shares)

Outstanding

Contracts

Range of

purchase prices

Average

purchase price

2007................................ 5.4 $54.74 $54.74

2008................................ 7.3 54.74 54.74

2009................................ 14.8 54.74 54.74

2010................................ 15.2 54.74 – 54.96 54.74

42.7 $54.74

The closing price of the Company’s common stock on December 30, 2005 was $55.09.

In December 2005, the Company retired 65 million shares of common stock held in treasury at an

average price of $37.35 per share. This retirement decreased the balance in treasury stock by $2.4 billion,

with corresponding decreases of $13 million in common stock and $2.4 billion in retained earnings.

OTHER RELATED EVENTS AND INFORMATION

Reauthorization

On February 8, 2006, the President signed the Higher Education Reconciliation Act of 2005

(“Reauthorization Legislation”). The Reauthorization Legislation was included as Title VIII of the Deficit

Reduction Act of 2005 (S. 1932), an omnibus budget bill that cut nearly $40 billion in spending over five

years, with $12 billion coming from federal student loan programs. The vast majority of the savings are

generated by requiring lenders to rebate Floor Income under the new loans issued after April 1, 2006. The

major new student loan provisions include the following, with effective dates generally July 1, 2006 unless

otherwise indicated:

•Lenders rebate Floor Income on new loans after April 1, 2006.

•Borrower origination fees are gradually reduced to zero in FFELP by 2010, and to one percent in

Direct Loan program by 2010.

•Collection of one percent FFELP guaranty fee is mandated for all guarantors, including those with

voluntary flexible agreements, but can be paid on behalf of the borrower by lenders or guarantors.

•Lender reinsurance is reduced to 99 percent with Exceptional Performer designation for claims

filed after July 1, 2006, and 97 percent without designation on loans disbursed after July 1, 2006.

•“Super 2-Step” and in-school consolidation loopholes will be closed as of July 1, 2006.

•Recycling of 9.5 percent loans is prohibited for loan holders with more than $100 million in 9.5

percent loans, as of date of enactment, and other 9.5 percent reforms enacted in 2004 are made

permanent.

•The limitation on SAP for PLUS loans made after January 1, 2000 is repealed.

•Loan limits are increased as of July 1, 2007.

•A moratorium on new schools-as-lender is created after April 1, 2006, and additional requirements

are created for schools continuing to participate in this program.

•Graduate students become eligible to take out PLUS loans.

•Compensation for guarantor collections via loan consolidation is reduced from a maximum of 18.5

percent to 10 percent, along with a cap on the proportion of collection via consolidations.

Requirements for collections via loan rehabilitations are made somewhat easier.

•New grant programs are available for Pell-eligible students.