Sallie Mae 2005 Annual Report Download - page 138

Download and view the complete annual report

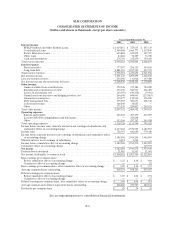

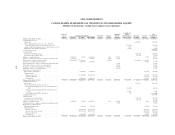

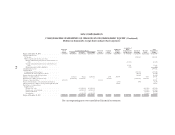

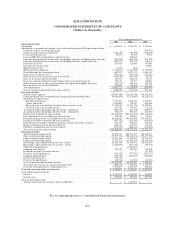

Please find page 138 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-16

2. Significant Accounting Policies (Continued)

inception and on an ongoing basis to determine if the amounts received are adequate compensation as

defined in SFAS No. 140. To the extent such compensation is determined to be no more or less than

adequate compensation, no servicing asset or obligation is recorded at the time of securitization.

Derivative Accounting

SFAS No. 133

The Company accounts for its derivatives, which include interest rate swaps, cross-currency interest

rate swaps, interest rate futures contracts, interest rate cap contracts, Floor Income Contracts and equity

forward contracts in accordance with SFAS No. 133, “Accounting for Derivative Instruments and Hedging

Activities,” which requires that every derivative instrument, including certain derivative instruments

embedded in other contracts, be recorded at fair value on the balance sheet as either an asset or liability.

The Company determines the fair value for its derivative contracts using either (i) pricing models that

consider current market conditions and the contractual terms of the derivative contract or (ii) counterparty

valuations. These factors include interest rates, time value, forward interest rate curve and volatility

factors, as well as foreign exchange rates. Pricing models and their underlying assumptions impact the

amount and timing of unrealized gains and losses recognized, and the use of different pricing models or

assumptions could produce different financial results.

Many of the Company’s derivatives, mainly interest rate swaps hedging the fair value of fixed rate

assets and liabilities, cross-currency interest rate swaps, and certain Eurodollar futures contracts, qualify as

effective hedges under SFAS No. 133. For these derivatives, the relationship between the hedging

instrument and the hedged items (including the hedged risk and method for assessing effectiveness), as

well as the risk management objective and strategy for undertaking various hedge transactions at the

inception of the hedging relationship is documented. Each derivative is designated to either a specific asset

or liability on the balance sheet or expected future cash flows, and designated as either a fair value or a

cash flow hedge. Fair value hedges are designed to hedge the Company’s exposure to changes in fair value

of a fixed rate or foreign denomination asset or liability (“fair value” hedge), while cash flow hedges are

designed to hedge the Company’s exposure to variability of either a floating rate asset’s or liability’s cash

flows or expected fixed rate debt issuance (“cash flow” hedge). For effective fair value hedges, both the

hedge and the hedged item (for the risk being hedged) are marked-to-market with any difference recorded

immediately in the income statement. For effective cash flow hedges, the change in the fair value of the

derivative is recorded in other comprehensive income, net of tax, and recognized in earnings in the same

period as the earnings effects of the hedged item. The ineffective portion of a cash flow hedge is recorded

immediately through earnings. The assessment of the hedge’s effectiveness is performed at inception and

on an ongoing basis. In general, regression testing is performed to assess hedge effectiveness. When it is

determined that a derivative is not currently an effective hedge or it will not be one in the future, the

Company discontinues the hedge accounting prospectively and ceases recording changes in the fair value

of the hedged item.

The Company also has a number of derivatives, primarily Floor Income Contracts, certain Eurodollar

futures contracts and certain basis swaps, that the Company believes are effective economic hedges but are

not considered hedges under SFAS No. 133. The Floor Income Contracts are written options which under

SFAS No. 133 have a more stringent effectiveness hurdle to meet. These derivatives are classified as