Sallie Mae 2005 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-2

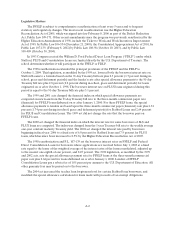

Legislative Matters

The FFELP is subject to comprehensive reauthorization at least every 5 years and to frequent

statutory and regulatory changes. The most recent reauthorization was the Higher Education

Reconciliation Act of 2005, which was signed into law February 8, 2006 as part of the Deficit Reduction

Act, Public Law 109-171. Other recent amendments since the program was previously reauthorized by the

Higher Education Amendments of 1998, include the Ticket to Work and Work Incentives Improvement

Act of 1999, by Public Law 106-554 (December 21, 2000), the Consolidated Appropriations Act of 2001, by

Public Law 107-139, (February 8, 2002) by Public Law 108-98 (October 10, 2003), and by Public Law

108-409 (October 30, 2004).

In 1993 Congress created the William D. Ford Federal Direct Loan Program (“FDLP”) under which

Stafford, PLUS and Consolidation Loans are funded directly by the U.S. Department of Treasury. The

school determines whether it will participate in the FFELP or FDLP.

The 1998 reauthorization extended the principal provisions of the FFELP and the FDLP to

October 1, 2004. This legislation, as modified by the 1999 act, lowered both the borrower interest rate on

Stafford Loans to a formula based on the 91-day Treasury bill rate plus 2.3 percent (1.7 percent during in-

school, grace and deferment periods) and the lender’s rate after special allowance payments to the 91-day

Treasury bill rate plus 2.8 percent (2.2 percent during in-school, grace and deferment periods) for loans

originated on or after October 1, 1998. The borrower interest rate on PLUS loans originated during this

period is equal to the 91-day Treasury bill rate plus 3.1 percent.

The 1999 and 2001 acts changed the financial index on which special allowance payments are

computed on new loans from the 91-day Treasury bill rate to the three-month commercial paper rate

(financial) for FFELP loans disbursed on or after January 1, 2000. For these FFELP loans, the special

allowance payments to lenders are based upon the three-month commercial paper (financial) rate plus 2.34

percent (1.74 percent during in-school, grace and deferment periods) for Stafford Loans and 2.64 percent

for PLUS and Consolidation Loans. The 1999 act did not change the rate that the borrower pays on

FFELP loans.

The 2000 act changed the financial index on which the interest rate for some borrowers of SLS and

PLUS loans are computed. The index was changed from the 1-year Treasury bill rate to the weekly average

one-year constant maturity Treasury yield. The 2002 act changed the interest rate paid by borrowers

beginning in fiscal year 2006 to a fixed rate of 6.8 percent for Stafford loans and 7.9 percent for PLUS

loans, which has since been increased to 8.5% by the Higher Education Reconciliation Act of 2005.

The 1998 reauthorization and P.L. 107-139 set the borrower interest rates on FFELP and Federal

Direct Consolidation Loans for borrowers whose applications are received before July 1, 2003 at a fixed

rate equal to the lesser of the weighted average of the interest rates of the loans consolidated, adjusted up

to the nearest one-eighth of one percent, and 8.25 percent. The 1998 legislation, as modified by the 1999

and 2002 acts, sets the special allowance payment rate for FFELP loans at the three-month commercial

paper rate plus 2.64 percent for loans disbursed on or after January 1, 2000. Lenders of FFELP

Consolidation Loans pay a rebate fee of 1.05 percent per annum to the U.S. Department of Education. All

other guaranty fees may be passed on to the borrower.

The 2004 act increased the teacher loan forgiveness level for certain Stafford loan borrowers, and

modified the special allowance calculation for loans made with proceeds of tax-exempt obligations.