Sallie Mae 2005 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-63

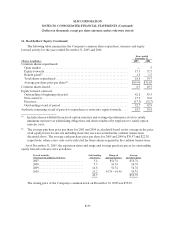

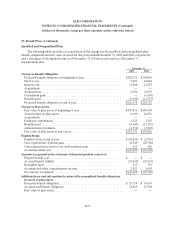

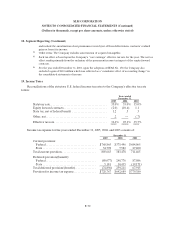

17. Benefit Plans (Continued)

Qualified and Nonqualified Plans

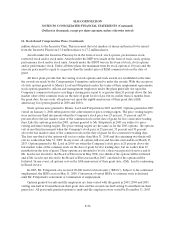

The following tables provide a reconciliation of the changes in the qualified and nonqualified plan

benefit obligations and fair value of assets for the years ended December 31, 2005 and 2004, respectively,

and a statement of the funded status as of December 31 of both years based on a December 31

measurement date.

December 31,

2005 2004

Change in Benefit Obligation

Projected benefit obligation at beginningof year.......................... $202,352 $184,019

Service cost........................................................... 9,893 10,862

Interestcost.......................................................... 11,208 11,237

Acquisitions.......................................................... — —

Actuarial loss......................................................... 2,380 14,279

Curtailment gain...................................................... — (6,310)

Benefits paid ......................................................... (9,695) (11,735)

Projected benefit obligation at end of year................................ $216,138 $202,352

Change in Plan Assets

Fairvalue ofplan assets atbeginning of year.............................. $199,816 $184,495

Actual returnon plan assets............................................ 8,160 26,856

Acquisitions.......................................................... — —

Employercontribution................................................. 1,225 1,745

Benefits paid ......................................................... (9,695) (11,735)

Administrative payments............................................... (1,534) (1,545)

Fairvalue ofplan assets atend of year................................... $197,972 $199,816

Funded Status

Funded status at end of year............................................ $(18,166) $ (2,536)

Unrecognized net actuarialgain......................................... (8,349) (20,780)

Unrecognized priorservicecost and transition asset....................... 112 186

Accrued pension cost.................................................. $(26,403) $(23,130)

Amounts recognized in the statement of financial position consist of:

Prepaid benefit cost ................................................... $ — $ —

Accrued benefit liability................................................ (29,447) (25,091)

Intangibleasset....................................................... 213 356

Accumulated other comprehensive income ............................... 2,831 1,605

Net amount recognized ................................................ $(26,403) $(23,130)

Additional year-end information for plans with accumulated benefit obligations

in excess of plan assets:

Projected benefit obligation ............................................ $ 25,716 $ 19,643

Accumulated benefit obligation ......................................... 21,869 19,500

Fair valueof planassets................................................ — —