Sallie Mae 2005 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-57

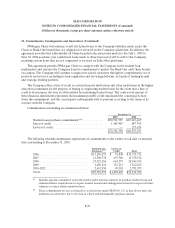

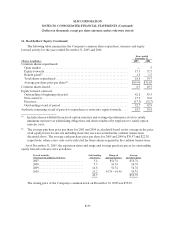

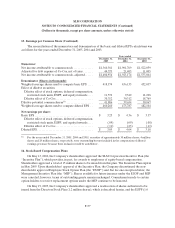

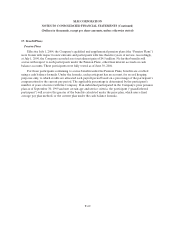

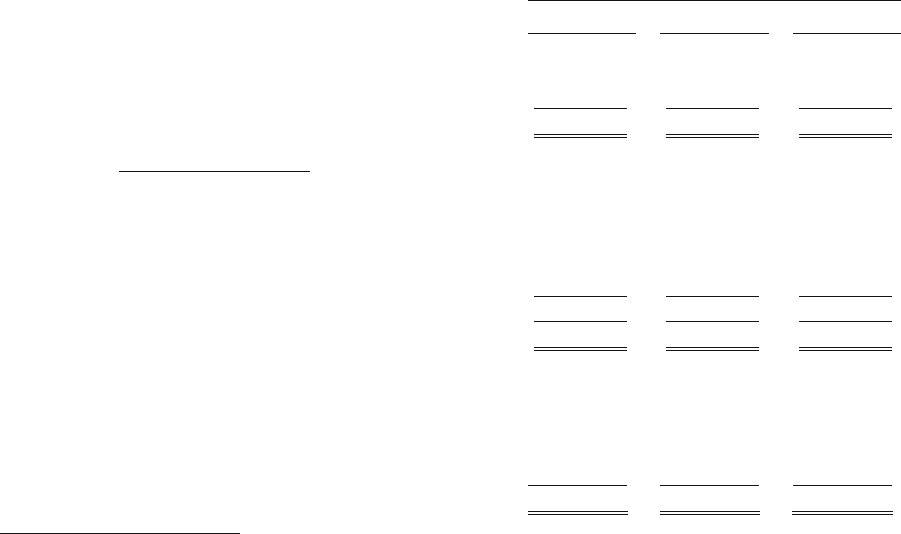

15. Earnings per Common Share (Continued)

The reconciliation of the numerators and denominators of the basic and diluted EPS calculations was

as follows for the years ended December 31, 2005, 2004 and 2003:

Years ended

December 31,

2005

December 31,

2004

December 31,

2003

Numerator:

Net income attributable to common stock .............. $1,360,381 $1,901,769 $1,522,059

Adjusted fordebt expenseof Co-Cos,net of taxes....... 44,573 21,405 11,005

Net income attributable to common stock, adjusted...... $1,404,954 $1,923,174 $1,533,064

Denominator (Shares in thousands):

Weighted-average sharesused to compute basic EPS.... 418,374 436,133 452,037

Effect of dilutive securities:

Dilutive effect of stock options, deferred compensation,

restricted stock units, ESPP, and equity forwards.... 11,574 9,342 11,298

Dilutive effect of Co-Cos........................... 30,312 30,312 18,769

Dilutive potential common shares(1) ................... 41,886 39,654 30,067

Weighted-average shares used to compute diluted EPS . . 460,260 475,787 482,104

Net earnings per share:

BasicEPS.......................................... $ 3.25 $ 4.36 $ 3.37

Dilutive effect of stock options, deferred compensation,

restricted stock units, ESPP, and equity forwards.... (.09) (.09) (.08)

Dilutive effect of Co-Cos........................... (.11) (.23) (.11)

DilutedEPS........................................ $ 3.05 $ 4.04 $ 3.18

(1) For the years ended December 31, 2005, 2004 and 2003, securities of approximately 30 million shares, 4 million

shares and 29 million shares, respectively, were outstanding but not included in the computation of diluted

earnings per share because their inclusion would be antidilutive.

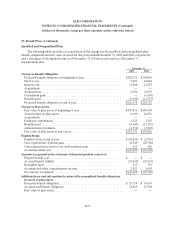

16. Stock-Based Compensation Plans

On May 13, 2004, the Company’s shareholders approved the SLM Corporation Incentive Plan (the

“Incentive Plan”), which provides, in part, for awards to employees of equity-based compensation.

Shareholders approved a total of 15 million shares to be issued from this plan. The Incentive Plan expires

in May 2009. Upon shareholders’ approval of the Incentive Plan, the Company discontinued the non-

shareholder approved Employee Stock Option Plan (the “ESOP”) and, but for one exception below, the

Management Incentive Plan (the “MIP”). Shares available for future issuance under the ESOP and MIP

were canceled; however, terms of outstanding grants remain unchanged. Commitments made to certain

option holders to receive replacement options under the MIP continue to be honored.

On May 19, 2005, the Company’s shareholders approved a reallocation of shares authorized to be

issued from the Directors Stock Plan (1.2 million shares), which is described herein, and the ESPP (1.0