Sallie Mae 2005 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-20

2. Significant Accounting Policies (Continued)

In December 2004, the FASB issued SFAS No. 123(R), “Share-Based Payment,” which is a revision of

SFAS No. 123 (for further discussion, see “Recently Issued Accounting Pronouncements—Share-Based

Payment” below). The Company adopted SFAS No. 123(R) on January 1, 2006 using the modified-

prospective transition method.

Income Taxes

Income taxes are recorded in accordance with SFAS No. 109, “Accounting for Income Taxes.” The

asset and liability approach underlying SFAS No. 109 requires the recognition of deferred tax liabilities

and assets for the expected future tax consequences of temporary differences between the carrying

amounts and tax basis of the Company’s assets and liabilities. To the extent tax laws change, deferred tax

assets and liabilities are adjusted in the period that the tax change is enacted.

“Income tax expense” includes (i) deferred tax expense, which represents the net change in the

deferred tax asset or liability balance during the year plus any change in a valuation allowance, and

(ii) current tax expense, which represents the amount of tax currently payable to or receivable from a tax

authority plus amounts accrued for expected tax deficiencies (including both tax and interest).

In accordance with SFAS No. 5, “Accounting for Contingencies,” the Company records a reserve for

expected controversies with the Internal Revenue Service and various state taxing authorities when it is

deemed that deficiencies arising from such controversies are probable and reasonably estimable. This

reserve includes both tax and interest on these deficiencies.

Minority Interest in Subsidiaries

At December 31, 2005, minority interest in subsidiaries represents interests held by minority

shareholders in AFS Holdings, LLC of approximately 24 percent. At December 31, 2004, minority interest

in subsidiaries included interests in AFS Holdings, LLC and Washington Transferee Corporation of

approximately 36 percent and 34 percent, respectively.

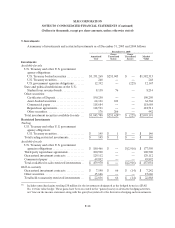

Earnings per Common Share

The Company computes earnings per common share (“EPS”) in accordance with SFAS No. 128,

“Earnings per Share.” Basic earnings per common share (“Basic EPS”) are calculated using the weighted

average number of shares of common stock outstanding during each period. Diluted earnings per common

share (“Diluted EPS”) reflect the potential dilutive effect of: (i) additional common shares that are

issuable upon exercise of outstanding stock options, deferred compensation, restricted stock units, and the

outstanding commitment to issue shares under the Employee Stock Purchase Plan, determined by the

treasury stock method, (ii) the assumed conversion of convertible notes, determined by the “if-converted”

method and (iii) equity forward contracts, determined by the reverse treasury stock method. See Note 15,

“Earnings per Common Share,” for further discussion.