Sallie Mae 2005 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-46

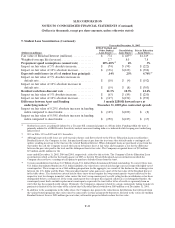

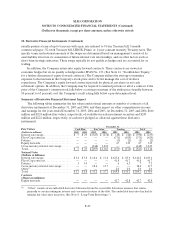

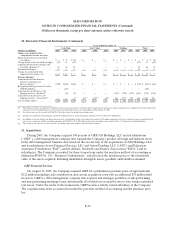

10. Derivative Financial Instruments (Continued)

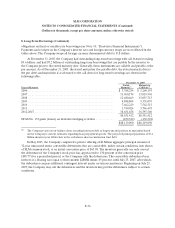

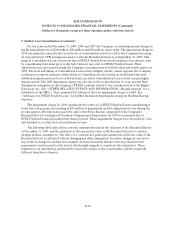

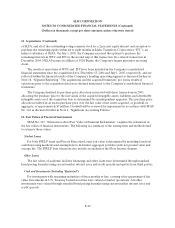

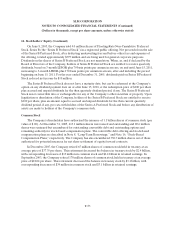

Years ended December 31,

Cash Flow Fair Value Trading Total

(Dollars in millions) 2005 2004 2003 2005 2004 2003 2005 2004 2003 2005 2004 2003

Changes to accumulated other

comprehensive income, net of tax

Hedge ineffectiveness reclassified

to earnings ................... $ — $ 9 $ (1) $ — $ — $ — $ — $ — $ — $ — $ 9 $ (1)

Change in fair value of cash flow hedges (27 ) 22 (12) — — — — — — (27 ) 22 (12)

Amortization of effective hedges and

transition adjustment(1) .......... 25 26 15 — — — — — — 25 26 15

Discontinued hedges .............. 15 1 5 — — — — — — 15 1 5

Change in accumulated other

comprehensive income, net ....... $ 13 $ 58 $ 7 $ — $ — $ — $ — $ — $ — $ 13 $ 58 $ 7

Earnings Summary

Amortization of closed futures

contracts’ gains/losses in

interest expense(2) .............. $ (39 ) $ (40 ) $ (24) $ — $ — $ — $ — $ — $ — $ (39 ) $ (40) $ (24)

Recognition of hedge losses related to

GSE Wind-Down .............. — (10 ) — — — — — — — — (10) —

Gains (losses) on derivative and

hedging activities—Realized(3) ..... — (4 ) (7) — — — (387) (709 ) (732 ) (387 ) (713) (739)

Gains (losses) on derivative and

hedging activities—Unrealized(4) ... — — 1(5) (3)

(5) (15)(5) (1)(5) 637 1,577 501 634 1,562 501

Total earnings impact ............. $ (39 ) $ (54 ) $ (30) $ (3) $ (15) $ (1) $ 250 $ 868 $ (231 ) $ 208 $ 799 $ (262)

(1) The Company expects to amortize $12 million of after-tax net losses from accumulated other comprehensive income to earnings during the next 12 months related to closed futures

contracts that were hedging the forecasted issuance of debt instruments that are outstanding as of December 31, 2005.

(2) For futures contracts that qualify as SFAS No. 133 hedges where the hedged transaction occurs.

(3) Includes net settlement income/expense related to trading derivatives and realized gains and losses related to derivative dispositions.

(4) In addition to the unrealized gains (losses) on derivative and hedging activities, the Company recorded a $130 million cumulative effect of accounting change for equity forward

contracts in accordance with the transition provisions of SFAS No. 150 in 2003. Explanation of the transition can be found in Note 2, “Significant Accounting Policies”.

(5) The change in fair value of cash flow and fair value hedges represents amounts related to ineffectiveness.

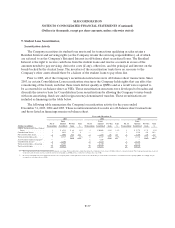

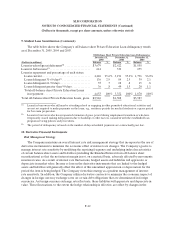

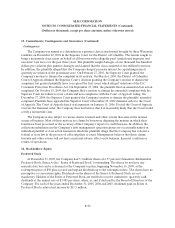

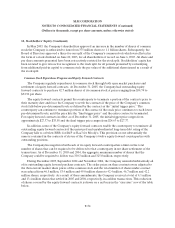

11. Acquisitions

During 2005, the Company acquired 100 percent of GRP/AG Holdings, LLC and its subsidiaries

(“GRP”), a debt management company that expands the Company’s product offerings and industry reach

in the debt management business and closed on the second step of the acquisitions of AFS Holdings, LLC

and its subsidiaries Arrow Financial Services, LLC and Arrow Funding, LLC (“AFS”) and Education

Assistance Foundation (“EAF”) and its affiliate, Student Loan Finance Association (“SLFA”) and its

subsidiaries. The Company accounted for these transactions under the purchase method of accounting as

defined in SFAS No. 141, ‘‘Business Combinations,’’ and allocated the purchase price to the fair market

value of the assets acquired, including identifiable intangible assets, goodwill, and liabilities assumed.

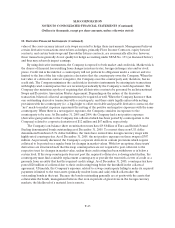

GRP Financial Services

On August 31, 2005, the Company acquired GRP for a preliminary purchase price of approximately

$122 million including cash consideration and certain acquisition costs with an additional $15 million held

in escrow. GRP is a debt management company that acquires and manages portfolios of sub-performing

and non-performing mortgage loans, substantially all of which are secured by one-to-four family residential

real estate. Under the terms of this transaction, GRP became a wholly owned subsidiary of the Company.

The acquisition has been accounted for under the purchase method of accounting and the purchase price

has