Sallie Mae 2005 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214

|

|

82

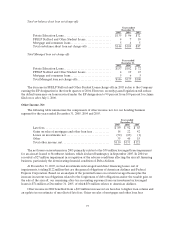

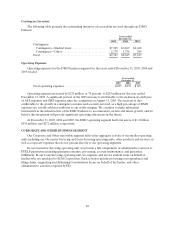

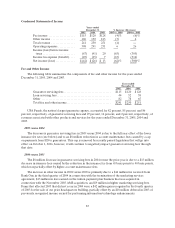

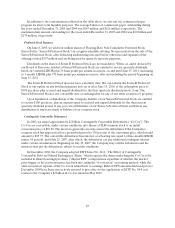

Contingency Inventory

The following table presents the outstanding inventory of receivables serviced through our DMO

business.

Years ended

December 31,

2005 2004 2003

Contingency:

Contingency—Studentloans ........................ $7,205 $6,869 $6,628

Contingency—Other............................... 2,178 1,756 589

Total............................................... $9,383 $8,625 $7,217

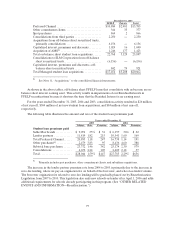

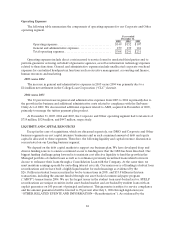

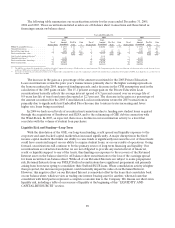

Operating Expenses

Operating expenses for the DMO business segment for the years ended December 31, 2005, 2004 and

2003 totaled:

Years ended

December 31,

2005 2004 2003

Total operating expenses.................................. $283 $159 $123

Operating expenses increased by $124 million, or 78 percent, to $283 million for the year ended

December 31, 2005. A significant portion of the 2005 increase is attributable to the inclusion of a full year

of AFS expenses and GRP expenses since the acquisition on August 31, 2005. The increase is also

attributable to the growth in contingency revenue and accounts serviced, as a high percentage of DMO

expenses are variable which contributes to our stable margins. We continue to make substantial

investments in the infrastructure of the DMO business to accommodate current and future growth, and we

believe this investment will provide significant operating efficiencies in the future.

At December 31, 2005, 2004 and 2003, the DMO operating segment had total assets of $1.1 billion,

$519 million, and $272 million, respectively.

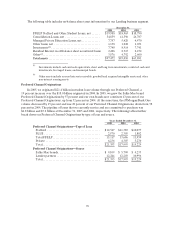

CORPORATE AND OTHER BUSINESS SEGMENT

Our Corporate and Other reportable segment reflects the aggregate activity of our smaller operating

units including our Guarantor Servicing and Loan Servicing operating units, other products and services, as

well as corporate expenses that do not pertain directly to our operating segments.

In our Guarantor Servicing operating unit, we provide a full complement of administrative services to

FFELP guarantors including guarantee issuance, processing, account maintenance, and guarantee

fulfillment. In our Loan Servicing operating unit, we originate and service student loans on behalf of

lenders who are unrelated to SLM Corporation. Such activities include processing correspondence and

filing claims, originating and disbursing Consolidation Loans on behalf of the lender, and other

administrative activities required by ED.