Sallie Mae 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

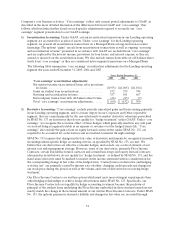

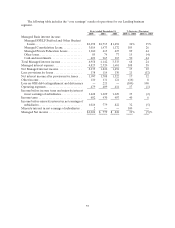

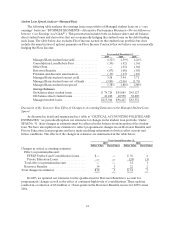

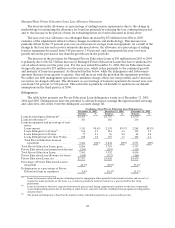

Student Loan Spread Analysis—Managed Basis

The following table analyzes the earnings from our portfolio of Managed student loans on a “core

earnings” basis (see “BUSINESS SEGMENTS—Alternative Performance Measures—Pre-tax differences

between ‘Core Earnings’ and GAAP”). This presentation includes both on-balance sheet and off-balance

sheet student loans and derivatives that are economically hedging the student loans on the debt funding

such loans. The table below also excludes Floor Income earned on the student loan portfolio but does

include the amortization of upfront payments on Floor Income Contracts that we believe our economically

hedging the Floor Income.

Years ended December 31,

2005 2004 2003

Managed Basis student loan yield................ 6.32% 4.59% 4.26 %

Consolidation Loan Rebate Fees ................ (.50) (.42) (.36 )

Offset Fees.................................... — (.02) (.04 )

Borrower Benefits ............................. (.07) (.08) (.05 )

Premium anddiscount amortization.............. (.17) (.13) (.10 )

Managed Basis student loan net yield............. 5.58 3.94 3.71

Managed Basis student loan cost of funds......... (3.80) (2.06) (1.71 )

Managed Basis student loan spread .............. 1.78% 1.88% 2.00 %

Average Balances

On-balance sheet student loans .................. $ 74,724 $55,885 $ 45,127

Off-balance sheet student loans.................. 41,220 40,558 38,205

Managed student loans......................... $115,944 $96,443 $ 83,332

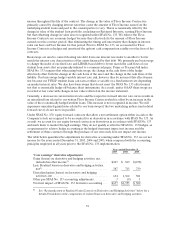

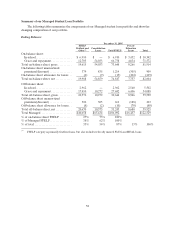

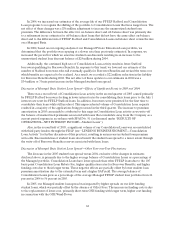

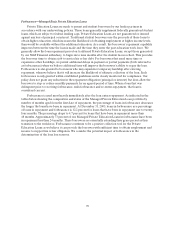

Discussion of the Year-over-Year Effect of Changes in Accounting Estimates on the Managed Student Loan

Spread

As discussed in detail and summarized in a table at “CRITICAL ACCOUNTING POLICIES AND

ESTIMATES,” we periodically update our estimates for changes in the student loan portfolio. Under

SFAS No. 91, these changes in estimates must be reflected in the balance from inception of the student

loan. We have also updated our estimates to reflect programmatic changes in our Borrower Benefits and

Private Education Loan programs and have made modeling refinements to better reflect current and

future conditions. The effects of the changes in estimates are summarized in the table below:

Years Ended December 31,

2005 2004

Dollar Value Basis Points Dollar Value Basis Points

Changes in critical accounting estimates:

Effect on premium/discount:

FFELP Stafford and Consolidation Loans..... $— — $ 36 4

Private Education Loans.................... — — (24) (3)

Total effect on premium/discount .............. — — 12 1

Borrower Benefits............................ 34 3 22 2

Total changes in estimates....................... $34 3 $ 34 3

In 2005, we updated our estimates for the qualification for Borrower Benefits to account for

programmatic changes as well as the effect of continued high levels of consolidations. These updates

resulted in a reduction of $34 million or 3 basis points in the Borrower Benefits reserve for 2005 versus

2004.