Sallie Mae 2005 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-50

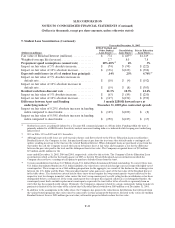

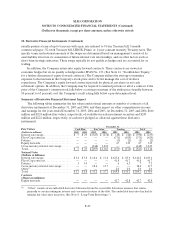

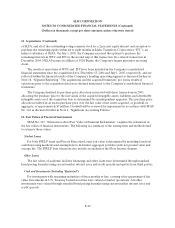

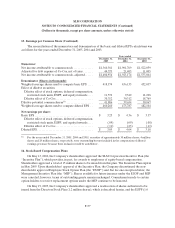

12. Fair Values of Financial Instruments (Continued)

Short-term Borrowings and Long-term Borrowings

For borrowings with remaining maturities of three months or less, carrying value approximated fair

value. The fair value of all other financial liabilities was determined through standard bond pricing

formulas using current market interest rates, foreign currency exchange rates and credit spreads and

quotes from third parties.

Derivative Financial Instruments

The fair values of derivative financial instruments were determined by a combination of pricing

through standard bond pricing formulas using current market interest rates, foreign currency exchange

rates, and credit spreads, and obtaining fair values from third parties.

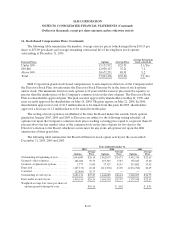

The following table summarizes the fair values of the Company’s financial assets and liabilities,

including derivative financial instruments.

December 31, 2005 December 31, 2004

(Dollars in millions)

Fair

Value

Carrying

Value Difference

Fair

Value

Carrying

Value Difference

Earning assets

FFELPloans............................ $ 76,492 $ 74,847 $ 1,645 $ 61,531 $ 60,561 $ 970

PrivateEducationLoans.................. 9,189 7,757 1,432 5,900 5,420 480

Otherloans.............................. 1,176 1,139 37 1,099 1,048 51

Cashandinvestments..................... 8,168 8,168 — 9,186 9,186 —

Totalearningassets ...................... 95,025 91,911 3,114 77,716 76,215 1,501

Interest bearing liabilities

Short-term borrowings .................... 3,806 3,810 4 2,210 2,207 (3)

Long-term borrowings .................... 88,220 88,119 (101) 76,085 75,915 (170)

Totalinterestbearingliabilities............ 92,026 91,929 (97) 78,295 78,122 (173)

Derivative financial instruments

FloorIncome/CapContracts .............. (371) (371) — (625) (625) —

Interest rate swaps ....................... (390) (390) — (235) (235) —

Cross currency interest rate swaps.......... (148) (148) — 1,839 1,839 —

Equity forwards .......................... 67 67 — 139 139 —

Futurescontracts......................... (1) (1) — (2) (2) —

Excess of fairvalue over carrying value...... $3,017 $1,328

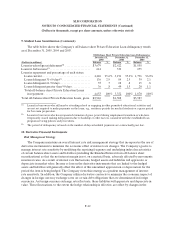

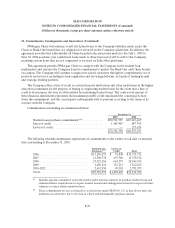

13. Commitments, Contingencies and Guarantees

JPMorgan Chase/Bank One Relationships

On March 22, 2005, the Company announced that it extended both its JPMorgan Chase and Bank One

student loan and loan purchase commitments to August 31, 2010. This comprehensive agreement provided

for the dissolution of the joint venture between Chase and Sallie Mae that had been making student loans

under the Chase brand since 1996 and resolved a lawsuit filed by Chase on February 17, 2005. In

consideration for extending the agreement, the Company received a $40 million payment that will be

recognized over the life of the agreement.