Sallie Mae 2005 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-29

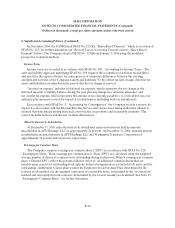

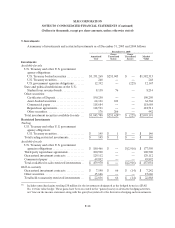

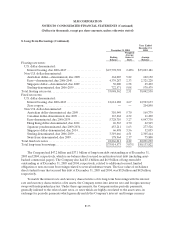

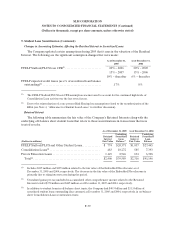

5. Investments (Continued)

December 31, 2004

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Market

Value

Investments

Trading

U.S. Treasury and other U.S. government

agency obligations:

U.S.Treasurysecurities.................... $ 148 $ 7 $ — $ 155

Total investment securitiestrading ............ $ 148 $ 7 $ — $ 155

A

vailable-for-sale

U.S. Treasury and other U.S. government

agency obligations:

U.S.Treasurybackedsecurities............. $ 1,483,102 $ 388,095 $(520) $ 1,870,677

U.S. government-guaranteed securities ...... 155,888 1,709 — 157,597

U.S.Treasurysecurities.................... 103,365 3 (186) 103,182

U.S. government agencies obligations........ 51,446 105 (179) 51,372

State and political subdivisions of the U.S.:

Student loan revenuebonds................ 22,655 493 — 23,148

Other securities:

Certificates of Deposit..................... 550,300 — — 550,300

Asset-backedsecurities.................... 371,553 835 (99) 372,289

Commercial paper ........................ 139,986 — — 139,986

Othersecurities........................... 5,530 42 — 5,572

Total investment securities available-for-sale . . . $2,883,825 $391,282(1) $ (984 ) $ 3,274,123

Restricted Investments

A

vailable-for-sale

U.S. Treasury and other U.S. government

agenciesobligations....................... $ 197,373 $ — $(755) $ 196,618

Third party repurchase agreements............ 143,300 — — 143,300

Guaranteed investment contracts ............. 85,866 — — 85,866

Total available-for-sale restricted investments . . $ 426,539 $ — $ (755) $ 425,784

Held-to-maturity

Guaranteed investment contracts ............. $ 9,031 $ 131 $ (14) $ 9,148

Othersecurities............................. 2,718 — — 2,718

Total held-to-maturity restricted investments . . . $ 11,749 $ 131 $ (14) $ 11,866

(1) Includes unrealized gains totaling $128 million for the investments designated as the hedged items in a SFAS

No. 133 fair value hedge. These gains have been recorded in the “gains (losses) on derivative hedging activities,

net” line on the income statement along with the gain (loss) related to the derivatives hedging such investments.

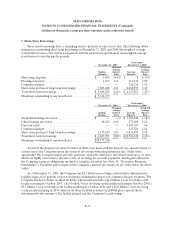

In addition to the restricted investments detailed above, at December 31, 2005 and 2004 the Company

had restricted cash of $2.8 billion and $1.8 billion, respectively.