Sallie Mae 2005 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214

|

|

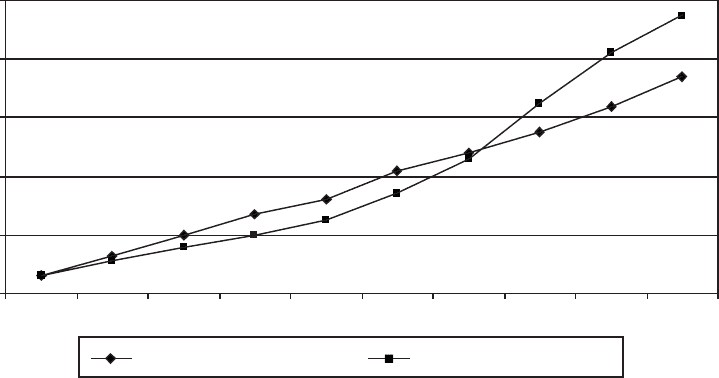

12

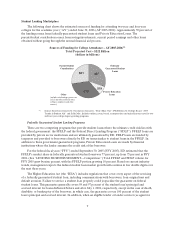

Cost of Attendance(1)

Cumulative % Increase from AY 1995

0

20

40

60

80

100

96-97 97-98 98-99 99-00 00-01 01-02 02-03 03-04 04-05 05-06

Tuition & Fees 4-Year Private Tuition & Fees 4-Year Public

Source: The College Board

(1) Cost of attendance is in current dollars and includes tuition, fees, on-campus room and board

fees.

Sallie Mae’s Lending Business

Our primary marketing point-of-contact is the school’s financial aid office where we focus on

delivering flexible and cost-effective products to the school and its students. Our sales force, which works

with financial aid administrators on a daily basis, is the largest in the industry and currently markets the

following internal lender brands: Academic Management Services (“AMS”), Nellie Mae, Sallie Mae

Educational Trust, SLM Financial, Student Loan Funding Resources (“SLFR”), Southwest Student

Services (“Southwest”) and Student Loan Finance Association (“SLFA”). We also actively market the loan

guarantee of United Student Aid Funds, Inc. (“USA Funds”) and its affiliate Northwest Education Loan

Association (“NELA”) through a separate sales force.

We acquire student loans from three principal sources:

•our Preferred Channel;

•Consolidation Loans; and

• strategic acquisitions.

Over the past several years we have successfully changed our business model from a wholesale

purchaser of loans on the secondary market, to a direct origination model where we control the front-end

origination process. This provides us with higher yielding loans with lower acquisition costs that have a

longer duration because we originate or purchase them at or immediately after full disbursement. The key

measure of this successful transition is the growth in our Preferred Channel Originations, which, in 2005,

accounted for 75 percent of Managed student loan acquisitions.

In 2005, we originated $21.4 billion in student loans through our Preferred Channel, of which a total

of $9.1 billion or 43 percent was originated through our owned brands, $5.9 billion or 28 percent was

originated through our largest lending partner, JPMorgan Chase (including Bank One acquired by

JPMorgan in 2004) and $6.3 billion or 30 percent was originated through other lender partners. This mix of

Preferred Channel Originations marks a significant shift from the past, when Bank One and JPMorgan