Sallie Mae 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.13

Chase were the largest component of our Preferred Channel Originations, and reflects the changing nature

of our relationship with Bank One and JPMorgan Chase following their merger in 2004. In 2004, we

originated $6.9 billion or 38 percent of our Preferred Channel through Bank One and JPMorgan Chase.

On March 22, 2005, the Company announced that it extended both its JPMorgan Chase and Bank

One student loan and loan purchase commitments to August 31, 2010. This comprehensive agreement

provided for the dissolution of the joint venture between Chase and Sallie Mae that had been making

student loans under the Chase brand since 1996 and resolved a lawsuit filed by Chase on February 17,

2005.

JPMorgan Chase will continue to sell substantially all student loans to the Company (whether made

under the Chase or Bank One brand) that are originated or serviced on the Company’s platforms. In

addition, the agreement provides that substantially all Chase-branded education loans made for the July 1,

2005 to June 30, 2006 academic year (and future loans made to these borrowers) will be sold to the

Company, including certain loans that are not originated or serviced on Sallie Mae platforms.

This agreement permits JPMorgan Chase to compete with the Company in the student loan

marketplace and releases the Company from its commitment to market the Bank One and Chase brands

on campus.

Our Preferred Channel Originations growth has been fueled by both new business from schools

leaving the FDLP or other FFELP lending relationships, same school sales growth, and growth in the for-

profit sector. Since 1999, we have partnered with over 100 schools that have chosen to return to the FFELP

from the FDLP. Our FFELP originations at these schools totaled over $1.6 billion in 2005. In addition to

winning new schools, we have also forged broader relationships with many of our existing school clients.

Our FFELP and private originations at for-profit schools have grown faster than at traditional higher

education schools due to enrollment trends as well as our increased market share of lending to these

institutions.

Consolidation Loans

Over the past four years, we have seen a surge in consolidation activity as a result of historically low

interest rates. This growth has contributed to the changing composition of our student loan portfolio.

Consolidation Loans earn a lower yield than FFELP Stafford Loans due primarily to the Consolidation

Loan Rebate Fee. This negative impact is somewhat mitigated by the longer average life of Consolidation

Loans. We have made a substantial investment in consolidation marketing to protect our asset base and

grow our portfolio, including targeted direct mail campaigns and web-based initiatives for borrowers.

Weighing against this investment is a recent practice by which some FFELP lenders use the Direct Lending

program as a pass-through vehicle to circumvent the statutory prohibition on refinancing an existing

FFELP Consolidation Loan in cases where the borrower is not eligible to consolidate his or her loans. This

practice will be prohibited under the recently passed student loan Reauthorization Legislation. (See “Risk

Factors—LENDING BUSINESS SEGMENT—FFELP STUDENT LOANS.”) In 2005, these

developments resulted in a net Managed portfolio loss of $26 million from consolidation activity. During

2005, $17.1 billion of FFELP Stafford loans in our Managed loan portfolio consolidated either with us

($14.0 billion) or with other lenders ($3.1 billion). Consolidation Loans now represent over 73 percent of

our on-balance sheet federally guaranteed student loan portfolio and over 62 percent of our Managed

federally guaranteed portfolio.

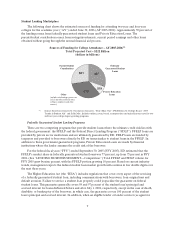

Private Education Loans

The rising cost of education has led students and their parents to seek additional private credit sources

to finance their education. Private Education Loans are often packaged as supplemental or companion

products to FFELP loans and priced and underwritten competitively to provide additional value for our

school relationships. In certain situations, a for-profit school shares the borrower credit risk. Over the last