Sallie Mae 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.62

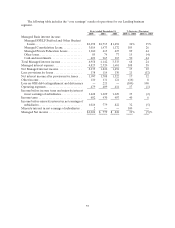

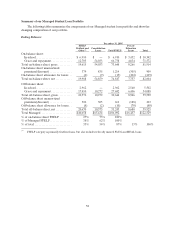

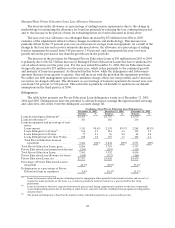

In 2004, we increased our estimates of the average life of our FFELP Stafford and Consolidation

Loan programs to recognize the shifting of the portfolio to Consolidation Loans that have longer lives. The

net effect of these changes was a $36 million adjustment to increase the unamortized student loan

premium. The difference between the effect for on-balance sheet and off-balance sheet was primarily due

to a refinement in our estimates for off-balance sheet loans that did not have the same effect on-balance

sheet and to the different mix of FFELP Stafford and Consolidation Loans on-balance sheet versus the mix

on a Managed Basis.

In 2004, based on our ongoing analysis of our Managed Private Education Loan portfolio, we

determined that the portfolio was repaying at a slower rate than previously estimated. In response, we

increased the period for which we amortize student loan discounts resulting in an increase to the

unamortized student loan discount balance of $24 million during 2004.

Additionally, the continued high rate of Consolidation Loan activity results in fewer Stafford

borrowers qualifying for Borrower Benefits. In response to this trend, we lowered our estimate of the

number of Stafford borrowers who will eventually qualify for Borrower Benefits and revised the term over

which benefits are expected to be realized. As a result, we recorded a $22 million reduction in the liability

for Borrower Benefits during 2004. The net effect of these updates to our estimates in 2004 was a

$34 million or 3 basis point increase in the Managed student loan spread.

Discussion of Managed Basis Student Loan Spread—Effects of Significant Events in 2005 and 2004

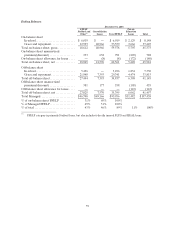

There was a record level of Consolidation Loan activity in the second quarter of 2005 caused primarily

by FFELP Stafford borrowers locking in lower interest rates by consolidating their loans prior to the July 1

interest rate reset for FFELP Stafford loans. In addition, borrowers were permitted for the first time to

consolidate their loans while still in school. This unprecedented volume of Consolidation Loan requests

resulted in a majority of the applications being processed in the third quarter. The increase to premium

amortization in 2005 can mainly be attributed to this surge in Consolidation Loan activity as we write-off

the balance of unamortized premiums associated with loans that consolidate away from the Company as a

current period expense in accordance with SFAS No. 91 (as discussed under “RESULTS OF

OPERATIONS—NET INTEREST INCOME—Student Loans”).

Also, in the second half of 2005, a significant volume of our Consolidation Loans was reconsolidated

with third party lenders through the FDLP (see “LENDING BUSINESS SEGMENT—Consolidation

Loan Activity” for further discussion of this practice), resulting in an increase in student loan premium

write-offs. Reconsolidation of student loans does benefit the student loan spread to a lesser extent through

the write-off of Borrower Benefits reserves associated with these loans.

Discussion of Managed Basis Student Loan Spread—Other Year-over-Year Fluctuations

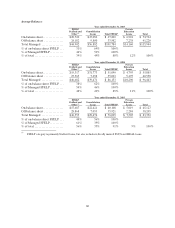

The decrease in the 2005 student loan spread versus 2004, exclusive of the changes in estimates

disclosed above, is primarily due to the higher average balance of Consolidation Loans as a percentage of

the Managed portfolio. Consolidation Loans have lower spreads than other FFELP loans due to the 105

basis point Consolidation Loan Rebate Fee, higher qualification rates for Borrower Benefits, and higher

funding costs due to their longer terms. These negative effects are partially offset by lower student loan

premium amortization due to the extended term and a higher SAP yield. The average balance of

Consolidation Loans grew as a percentage of the average Managed FFELP student loan portfolio from 46

percent in 2004 to 56 percent in 2005.

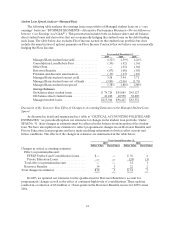

In 2005, our Managed student loan spread was impacted by higher spreads on our debt funding

student loans, which was partially offset by the absence of Offset Fees. The increase in funding costs is due

to the replacement of lower cost, primarily short-term GSE funding with longer term, higher cost funding

in connection with the GSE Wind-Down.