Sallie Mae 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.16

Competition

Our primary competitor for federally guaranteed student loans is the FDLP, which in its first four

years of existence (FFYs 1994-1997) grew market share from 4 percent in FFY 1994 to a peak of 34

percent in FFY 1997, but has steadily declined since then to a 23 percent market share in FFY 2005 for the

total federally sponsored student loan market. We also face competition for both federally guaranteed and

non-guaranteed student loans from a variety of financial institutions including banks, thrifts and state-

supported secondary markets. In addition, we face competition for federally guaranteed Consolidation

Loans from FFELP lenders who use the FDLP as a vehicle to circumvent the statutory prohibition on

refinancing an existing FFELP Consolidation Loan where the borrower is not eligible to consolidate his or

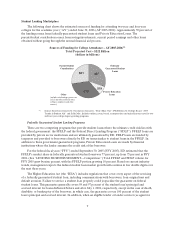

her loan (see “Risk Factors—GENERAL’’). Our FFY 2005 FFELP Preferred Channel Originations

totaled $14.9 billion, representing a 27 percent market share.

In the FFELP student lending marketplace, we are seeing increased use of discounts and Borrower

Benefits, as well as heightened interest in the school-as-lender model in which graduate and professional

schools make FFELP Stafford loans directly to eligible borrowers. The schools do not typically hold the

loans, preferring to sell them in the secondary market. According to ED, 88 institutions used the school-as-

lender model for FFY 2005, with total school-as-lender volume of $3.1 billion. The Reauthorization

Legislation ends new schools-as-lender after April 1, 2006 and adds additional requirements for schools

already participating in this program. (See “MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS—OTHER RELATED EVENTS AND

INFORMATION—Reauthorization.”)

In November 2005, we launched a zero-fee pricing initiative on all FFELP Stafford Loans that we

make to students nationwide during the AY 2006-2007, such that we pay the federally mandated three

percent origination fee on behalf of the borrower. Based on results achieved from a pilot program in seven

states, where we introduced zero-fee lending in 2005, we believe this competitive strategy will boost our

Preferred Channel volume at schools where we are now a preferred lender and help us win additional

school relationships. While the goal of this pricing initiative is to grow our FFELP loan volume, this

strategy will reduce our margins on the affected student loans until the origination fee is completely

eliminated by legislation in 2010.

DEBT MANAGEMENT OPERATIONS BUSINESS SEGMENT

We have used strategic acquisitions to build our DMO business and now have six operating units that

comprise our DMO business segment. In our DMO segment we provide a wide range of accounts

receivable and collections services including student loan default aversion services, defaulted student loan

portfolio management services, contingency collections services for student loans and other asset classes,

primarily a contingency or pay for performance business. We also provide accounts receivable

management and collections services on consumer and mortgage receivable portfolios that we purchase.

The table below presents a timeline of key acquisitions that have fueled the growth of our DMO business.

Our first and largest DMO acquisition was the USA Group in 2000, which launched us into the

student loan marketplace through a broad array of delinquency and default management services primarily

to guarantee agencies on a contingency fee or other pay-for-performance basis. We have since acquired

four additional companies that strengthened our presence in the student loan market and diversified our

product offerings to include a full range of receivables management collections and debt purchase services

across a wider customer base including large federal agencies, state agencies, credit card issuers, utilities,

and other holders of consumer debt.

In recent years we have diversified our DMO contingency revenue stream away from student loans,

mainly through the acquisition of AFS in 2004 and GRP in 2005. The acquisition of GRP further

diversified our purchased paper product offerings by providing us with the expertise to acquire and manage

portfolios of sub-performing and non-performing mortgage loans, substantially all of which are secured by