Sallie Mae 2005 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

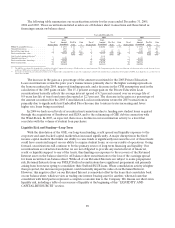

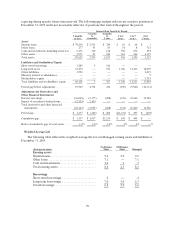

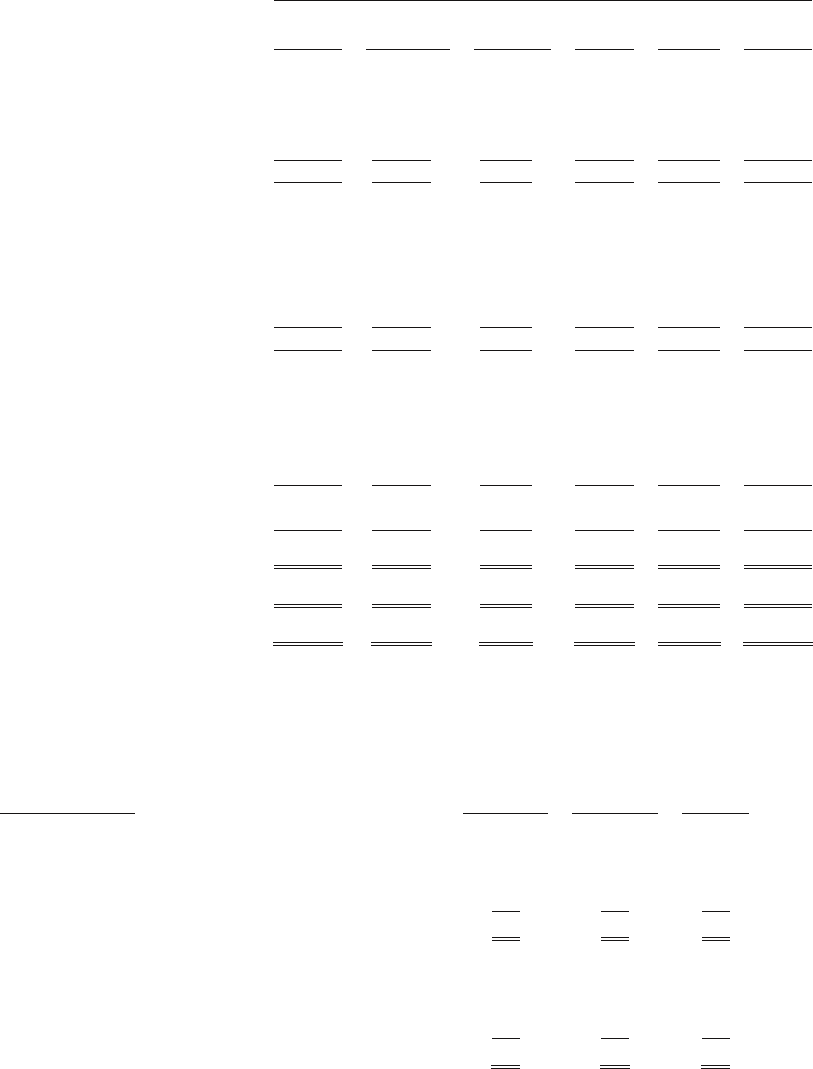

repricing during specific future time intervals. The following gap analysis reflects rate-sensitive positions at

December 31, 2005 and is not necessarily reflective of positions that existed throughout the period.

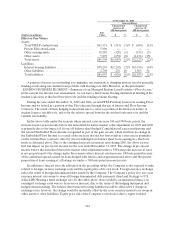

Interest Rate Sensitivity Period

3 months

or less

3 months

to

6 months

6 months

to

1 year

1 to 2

years

2 to 5

years

Over

5 years

Assets

Student loans.......................... $ 79,230 $ 2,513 $ 784 $ 10 $ 64 $ 3

Other loans........................... 277 43 85 14 8 711

Cash and investments, including restricted . 6,151 110 142 598 672 494

Other assets........................... 1,971 93 186 314 546 4,319

Total assets ........................... 87,629 2,759 1,197 936 1,290 5,527

Liabilities and Stockholders’ Equity

Short-term borrowings .................. 3,289 5 516 — — —

Long-term notes....................... 63,250 — 271 1,326 11,233 12,039

Other liabilities........................ 1,590 — — — — 2,019

Minority interest in subsidiaries .......... — — — — — 9

Stockholders’ equity .................... — — — — — 3,791

Total liabilities and stockholders’ equity . . . 68,129 5 787 1,326 11,233 17,858

Period gap before adjustments........... 19,500 2,754 410 (390 ) (9,943 ) (12,331)

Adjustments for Derivatives and

Other Financial Instruments

Interest rateswaps..................... (16,040) (5,177) (208) (741 ) 10,240 11,926

Impact of securitized student loans ....... (2,

103) 2,103 — — — —

Total derivatives and other financial

instruments......................... (18,143) (3,074) (208) (741 ) 10,240 11,926

Period gap............................ $ 1,357 $ (320) $ 202 $ (1,131 ) $ 297 $ (405)

Cumulative gap ........................ $ 1,357 $ 1,037 $ 1,239 $ 108 $ 405 $ —

Ratio of cumulative gap to total assets..... 1.4% 1.0% 1.2% .1% .4% —%

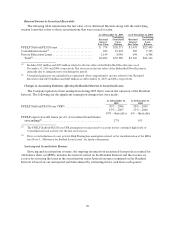

Weighted Average Life

The following table reflects the weighted average life for our Managed earning assets and liabilities at

December 31, 2005.

(Averages in years)

On-Balance

Sheet

Off-Balance

Sheet Managed

Earning assets

Student loans................................. 9.4 5.0 9.0

Other loans .................................. 7.1 — 7.1

Cash and investments ......................... 1.0 .1 .7

Total earningassets........................... 8.6 4.5 8.3

Borrowings

Short-term borrowings......................... .4 — .4

Long-term borrowings ......................... 7.0 5.0 6.3

Total borrowings.............................. 6.8 5.0 6.2