Sallie Mae 2005 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214

|

|

81

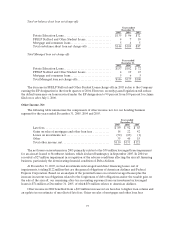

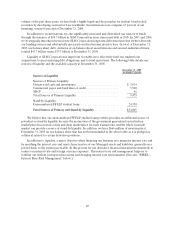

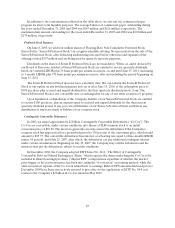

Purchased Paper—Non-Mortgage

Years ended

December 31,

2005 2004(1)

Face value ofpurchases.................................... $2,830 $426

Purchase price............................................ 198 19

% of face value purchased ................................. 7.0% 4.5%

Gross Cash Collections (“GCC”) ........................... $ 250 $ 59

Collections revenue ....................................... 157 39

% of GCC ............................................... 63% 66%

Carrying value of purchases................................ $ 158 $ 52

(1) AFS was purchased in September 2004. Prior to this acquisition, the Company was not in the

purchased paper business.

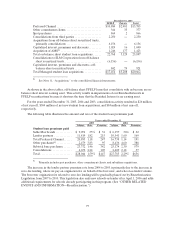

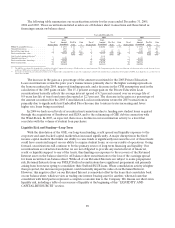

The amount of face value of purchases in any quarter is a function of a combination of factors

including the amount of receivables available for purchase in the marketplace, average age of each

portfolio, the asset class of the receivables, and competition in the marketplace. As a result, the percentage

of principal purchased will vary from quarter to quarter. The decrease in purchase paper revenue as a

percentage of GCC can primarily be attributed to the increase in new portfolio purchases in the second

half of 2005. Typically, revenue recognition based on a portfolio’s effective interest rate is a lower

percentage of cash collections in the early stages of servicing a portfolio.

Purchased Paper—Mortgage/Properties

Year ended

December 31, 2005(1)

Face value ofpurchases..................................... $165

Collections revenue ........................................ 10

Collateral value of purchases................................ 232

Purchase price............................................. 141

% of collateral value ....................................... 61%

Carrying value of purchases................................. $298

(1) GRP was purchased in August 2005. Prior to this acquisition, the Company was not in the mortgage

purchased paper business.

The purchase price for sub-performing and non-performing mortgage loans is generally determined as

a percentage of the underlying collateral. Fluctuations in the purchase price as a percentage of collateral

value can be caused by a number of factors including the percentage of second mortgages in the portfolio

and the level of private mortgage insurance associated with particular assets.