Sallie Mae 2005 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

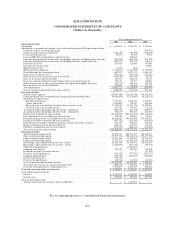

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-19

2. Significant Accounting Policies (Continued)

Accounting for Stock-Based Compensation

The Company has stock-based employee compensation plans and plans for non-employee members of

its Board of Directors, which are described more fully in Note 16, “Stock-Based Compensation Plans.” As

of December 31, 2005, the Company accounted for its stock options using the intrinsic value method of

accounting as prescribed by Accounting Principles Board (“APB”) Opinion No. 25, “Accounting for Stock

Issued to Employees.” Under APB No. 25, the Company does not recognize compensation expense on

fixed award plans unless the exercise price of its employee stock options is less than the market price of the

underlying stock on the date of grant. The Company grants all of its options at the fair market value of the

underlying stock on the date of grant. Consequently, the Company has not recorded such expense in the

periods presented.

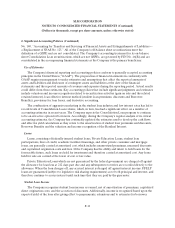

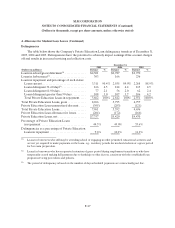

The fair values for the options granted in the years ended December 31, 2005, 2004 and 2003 were

estimated at the date of grant using a Black-Scholes option pricing model, with the following weighted

average assumptions:

Years Ended December 31,

2005 2004 2003

Riskfree interest rate............................................. 3.87% 2.59% 2.47%

Expectedvolatility................................................ 21.48% 16.27% 25.31%

Expected dividend rate............................................ 1.58% 1.66% 1.28%

Expected lifeof the option(in years) ............................... 3 years 3 years 3 years

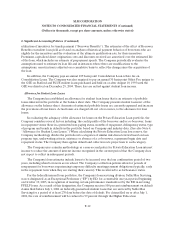

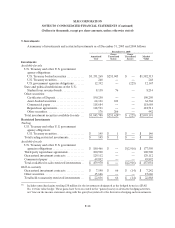

The following table summarizes pro forma disclosures for the years ended December 31, 2005, 2004

and 2003, as if the Company had accounted for employee and Board of Directors stock options granted

subsequent to December 31, 1994 under the fair market value method as set forth in SFAS No. 123, as

amended by SFAS No. 148, “Accounting for Stock-Based Compensation.” The option value is amortized

over an assumed vesting period of between one to three years or to the actual date of vesting, whichever

comes first.

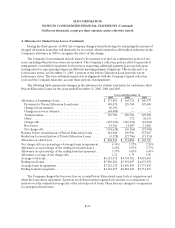

Years Ended December 31,

2005 2004 2003

Net income attributable to common stock ...................... $1,360,381 $1,901,769 $1,522,059

Less: Total stock-based employee compensation expense

determined under fair value based method for all awards,

net of related tax effects.................................... (39,499) (41,885) (85,503)

Pro formanet income attributable to commonstock............. $1,320,882 $1,859,884 $1,436,556

Basic earnings per common share, after cumulative effect of

accounting change......................................... $ 3.25 $ 4.36 $ 3.37

Pro forma basic earnings per common share, after cumulative

effect of accounting change................................. $ 3.16 $ 4.26 $ 3.18

Diluted earnings per common share, after cumulative effect of

accountingchange......................................... $ 3.05 $ 4.04 $ 3.18

Pro forma diluted earnings per common share, after cumulative

effect of accounting change................................. $ 2.97 $ 3.96 $ 3.00