Sallie Mae 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

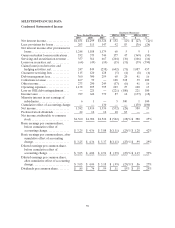

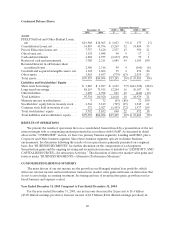

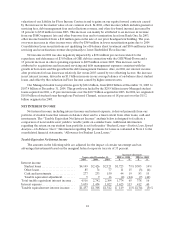

Years ended December 31, 2003-2005

(Dollars in millions, except per share amounts, unless otherwise stated)

FORWARD-LOOKING AND CAUTIONARY STATEMENTS

Some of the statements contained in this annual report discuss future expectations and business

strategies or include other “forward-looking” information. Those statements are subject to known and

unknown risks, uncertainties and other factors that could cause the actual results to differ materially from

those contemplated by the statements. The forward-looking information is based on various factors and

was derived using numerous assumptions.

OVERVIEW

We are the largest source of funding, delivery and servicing support for education loans in the United

States. Our primary business is to originate, acquire and hold both federally guaranteed student loans and

Private Education Loans, which are not federally guaranteed. The primary source of our earnings is from

net interest income earned on those student loans as well as gains on the sales of such loans in

securitization transactions. We also earn fees for pre-default and post-default receivables management

services on student loans, such that we are engaged in every phase of the student loan life cycle—from

originating and servicing student loans to default prevention and ultimately the collection on defaulted

student loans. Through recent acquisitions, we have expanded our receivables management services to a

number of different asset classes outside of student loans. We also provide a wide range of other financial

services, processing capabilities and information technology to meet the needs of educational institutions,

lenders, students and their families, and guarantee agencies. SLM Corporation, more commonly known as

Sallie Mae, is a holding company that operates through a number of subsidiaries. References in this report

to the “Company” refer to SLM Corporation and its subsidiaries.

We have used both internal growth and strategic acquisitions to attain our leadership position in the

education finance marketplace. Our sales force, which delivers our products on campuses across the

country, is the largest in the student loan industry. The core of our marketing strategy is to promote our

on-campus brands, which generate student loan originations through our Preferred Channel. Loans

generated through our Preferred Channel are more profitable than loans acquired through other

acquisition channels because we own them earlier in the student loan’s life and generally incur lower costs

to acquire such loans. We have built brand leadership through the Sallie Mae name, the brands of our

subsidiaries and those of our lender partners. These sales and marketing efforts are supported by the

largest and most diversified servicing capabilities in the industry, providing an unmatched array of services

to financial aid offices.

In recent years, we have diversified our business through the acquisition of several companies that

provide receivables management and debt collections services, all of which are combined in our Debt

Management Operations (“DMO”) operating segment. Initially these acquisitions were concentrated in

the student loan industry, but through our acquisitions of AFS Holdings, LLC, the parent company of

Arrow Financial Services, LLC (collectively, “AFS”) in September 2004 and GRP/AG Holdings, LLC and

its subsidiaries (“GRP”) in August 2005, we expanded our capabilities to include purchasing portfolios and

collecting on debt in a number of different industries. The DMO business segment has been expanding

rapidly such that revenue grew 55 percent in the year ended December 31, 2005 compared to 2004, and we

now employ approximately 3,500 people in this segment.