Sallie Mae 2005 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-56

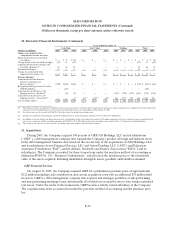

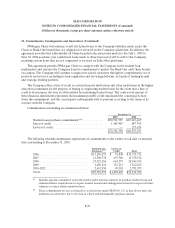

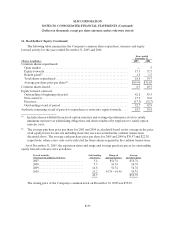

14. Stockholders’ Equity (Continued)

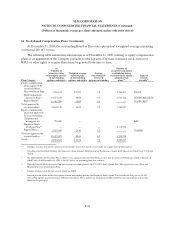

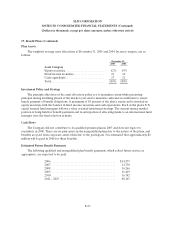

Accumulated Other Comprehensive Income

Accumulated other comprehensive income includes the after-tax change in unrealized gains and losses

on investments, unrealized gains and losses on derivatives, and the minimum pension liability adjustment.

The following table presents the cumulative balances of the components of other comprehensive income

for the years ended December 31, 2005, 2004 and 2003.

December 31,

2005 2004 2003

Net unrealized gains (losses) on investments(1) .................... $382,316 $467,374 $510,223

Net unrealized gains (losses) on derivatives(2) ..................... (12,560) (25,658) (83,302)

Minimum pension liability adjustment(3) .......................... (1,846) (1,044) (1,300)

Total accumulated other comprehensive income .................. $367,910 $440,672 $425,621

(1) Net of tax expense of $203,495, $251,178 and $274,736 for the years ended December 31, 2005, 2004 and 2003.

(2) Net of tax benefit of $4,667, $12,220 and $44,855 for the years ended December 31, 2005, 2004 and 2003.

(3) Net of tax benefit of $994, $562 and $700 for the years ended December 31, 2005, 2004 and 2003.

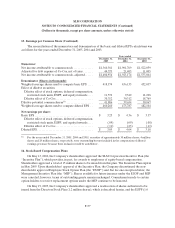

15. Earnings per Common Share

Basic earnings per common share (“basic EPS”) is calculated using the weighted average number of

shares of common stock outstanding during each period. Diluted earnings per common share (“diluted

EPS”) reflect the potential dilutive effect of (i) additional common shares that are issuable upon exercise

of outstanding stock options, deferred compensation, restricted stock units, and the outstanding

commitment to issue shares under the Employee Stock Purchase Plan (“ESPP”), determined by the

treasury stock method, (ii) the assumed conversion of convertible debentures, determined by the “if-

converted” method, and (iii) equity forward contracts, determined by the reverse treasury stock method.

Diluted EPS for the year ended December 31, 2003 also includes the dilutive effect of stock warrants,

which were exercised in June 2003.

At December 31, 2005, the Company had $2 billion contingently convertible debentures (“Co-Cos”)

outstanding that are convertible, under certain conditions, into shares of SLM common stock at an initial

conversion price of $65.98. The investors generally can only convert the debentures if the Company’s

common stock has appreciated to 130 percent of the conversion price ($85.77) for a prescribed period, or

the Company calls the debentures. Per EITF No. 04-8, diluted EPS for all periods presented includes the

potential dilutive effect of the Company’s outstanding Co-Cos for the years ended December 31, 2005,

2004 and 2003.