Sallie Mae 2005 Annual Report Download - page 209

Download and view the complete annual report

Please find page 209 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-11

percent to 97 percent, and insurance for claim requests on or after July 1, 2006 under an Exceptional

Performance designation is reduced from 100 percent to 99 percent.

The Department of Education reinsures guarantors for amounts paid to lenders on loans that are

discharged or defaulted. The reimbursement on discharged loans is for 100 percent of the amount paid to

the holder. The reimbursement rate for defaulted loans decreases as a guarantor’s default rate increases.

The first trigger for a lower reinsurance rate is when the amount of defaulted loan reimbursements exceeds

5 percent of the amount of all loans guaranteed by the agency in repayment status at the beginning of the

federal fiscal year. The second trigger is when the amount of defaults exceeds 9 percent of the loans in

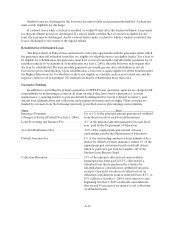

repayment. Guarantee agency reinsurance rates are presented in the table below.

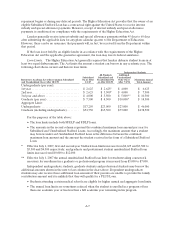

Claims Paid Date Maximum 5% Trigger 9% Trigger

Before October 1, 1993 ......................................... 100% 90% 80%

October 1, 1993 – September 30,1998 ............................ 98% 88% 78%

On or after October 1, 1998 ..................................... 95% 85% 75%

After the Department reimburses a guarantor for a default claim, the guarantor attempts to collect

the loan from the borrower. However, the Department requires that the defaulted guaranteed loans be

assigned to it when the guarantor is not successful. A guarantor also refers defaulted guaranteed loans to

the Department to “offset” any federal income tax refunds or other federal reimbursement which may be

due the borrowers. Some states have similar offset programs.

To be eligible for federal reinsurance, guaranteed loans must meet the requirements of the Higher

Education Act and regulations issued under the Act. Generally, these regulations require that lenders

determine whether the applicant is an eligible borrower attending an eligible institution, explain to

borrowers their responsibilities under the loan, ensure that the promissory notes evidencing the loan are

executed by the borrower; and disburse the loan proceeds as required. After the loan is made, the lender

must establish repayment terms with the borrower, properly administer deferrals and forbearances, credit

the borrower for payments made, and report the loan’s status to credit reporting agencies. If a borrower

becomes delinquent in repaying a loan, a lender must perform collection procedures that vary depending

upon the length of time a loan is delinquent. The collection procedures consist of telephone calls, demand

letters, skiptracing procedures and requesting assistance from the guarantor.

A lender may submit a default claim to the guarantor after a student loan has been delinquent for at

least 270 days. The guarantor must review and pay the claim within 90 days after the lender filed it. The

guarantor will pay the lender interest accrued on the loan for up to 450 days after delinquency. The

guarantor must file a reimbursement claim with the Department within 45 days (reduced to 30 days July 1,

2006) after the guarantor paid the lender for the default claim. Following payment of claims, the guarantor

endeavors to collect the loan. Guarantors also must meet statutory and regulatory requirements for

collecting loans.

Student Loan Discharges

FFELP loans are not generally dischargeable in bankruptcy. Under the United States Bankruptcy

Code, before a student loan may be discharged, the borrower must demonstrate that repaying it would

cause the borrower or his family undue hardship. When a FFELP borrower files for bankruptcy, collection

of the loan is suspended during the time of the proceeding. If the borrower files under the “wage earner”

provisions of the Bankruptcy Code or files a petition for discharge on the ground of undue hardship, then

the lender transfers the loan to the guarantee agency which then participates in the bankruptcy proceeding.

When the proceeding is complete, unless there was a finding of undue hardship, the loan is transferred

back to the lender and collection resumes.