Sallie Mae 2005 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-66

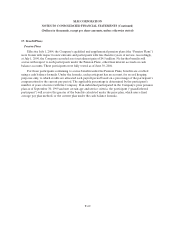

17. Benefit Plans (Continued)

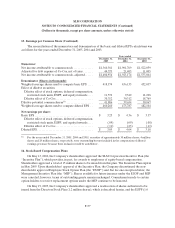

401(k) Plans

The Company maintains two safe harbor 401(k) savings plans as defined contribution plans intended

to qualify under section 401(k) of the Internal Revenue Code. The Sallie Mae 401(k) Savings Plan covers

substantially all employees of the Company outside of Debt Management Operations. Participating

employees as of July 1, 2005 may contribute up to 75 percent of eligible compensation; between July 1,

2004 and June 30, 2005 the maximum deferral percentage was 25 percent, and prior to July 1, 2004 the

maximum deferral was 10 percent of eligible compensation. Up to 6 percent of these contributions are

matched 100 percent by the Company after one year of service. Effective July 1, 2004, in conjunction with

the defined benefit plan change, certain eligible employees began receiving a 2 percent core employer

contribution. As additional employees phase out of the Pension Plans, they will begin receiving the 2

percent core employer contribution.

The Sallie Mae DMO 401(k) Savings Plan (“DMO Plan”) covers substantially all employees of Debt

Management Operations. Eligible employees can contribute up to 75 percent of eligible compensation as

of July 1, 2005 and up to 25 percent of eligible compensation between July 1, 2004 and July 1, 2005. The

DMO Plan has a match formula of up to 100 percent on the first 3 percent of contributions and 50 percent

on the next 2 percent of contributions after one year of service.

The Company also maintains a non-qualified plan to ensure that designated participants receive the

full amount of benefits to which they would have been entitled under the 401(k) Plan except for limits on

compensation imposed by the Internal Revenue Code.

Total expenses related to the 401(k) plans were $18 million, $19 million and $17 million in 2005, 2004

and 2003, respectively. This included discretionary shared success contributions by the company of $6

million and $5 million in 2004 and 2003, respectively. As a result of the July 2004 benefit plan changes the

Company made no discretionary employer contribution in 2005.

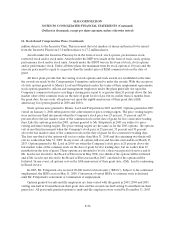

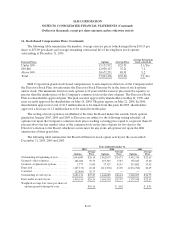

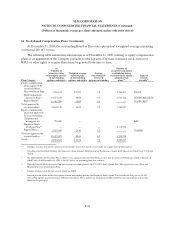

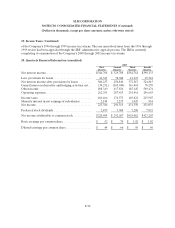

18. Segment Reporting

The Company has two primary operating segments as defined in SFAS No. 131, “Disclosures about

Segments of an Enterprise and Related Information”—the Lending and DMO segments. The Lending and

DMO operating segments meet the quantitative thresholds for reportable segments identified in SFAS

No. 131. Accordingly, the results of operations of the Company’s Lending and DMO operating segments

are presented below. The Company has smaller operating segments including the Guarantor Servicing and

Student Loan Servicing operating segments as well as certain other products and services provided to

colleges and universities which do not meet the quantitative thresholds identified in SFAS No. 131.

Therefore, the results of operations for these operating segments and the revenues and expenses

associated with these other products and services are combined with corporate overhead and other

corporate activities within the Corporate and Other reporting segment.

The management reporting process measures the performance of the Company’s operating segments

based on the management structure of the Company as well as the methodology used by management to

evaluate performance and allocate resources. Management, including the Company’s chief operating

decision maker, evaluates the performance of the Company’s operating segments based on their

profitability. As discussed further below, management measures the profitability of the Company’s