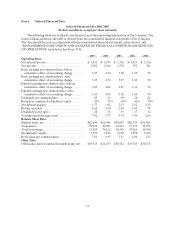

Sallie Mae 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.23

specified percentage per year or reduces their loan balance after they have made a specified initial number

of scheduled payments on time and for so long as they continue to make subsequent scheduled payments

on time. We regularly estimate the qualification rates for Borrower Benefits programs and book a level

yield adjustment based upon that estimate. If our estimate of the qualification rates is lower than the actual

rates, both the yield on our student loan portfolio and our net interest income will be lower than estimated

and a cumulative adjustment will be made to reduce income, possibly to a material extent. Such an

underestimation may also adversely affect the value of our Retained Interest because one of the

assumptions made in assessing its value is the amount of Borrower Benefits expected to be earned by

borrowers. Finally, we continue to look at new ways to attract new borrowers and to improve our

borrowers’ payment behavior. These efforts as well as the actions of competing lenders may lead to the

addition or modification of Borrower Benefits programs.

LENDING BUSINESS SEGMENT—PRIVATE EDUCATION LOANS

Changes in the composition of our Managed student loan portfolio will increase the risk profile of our asset base

and our capital requirements.

As of December 31, 2005, 13 percent of our Managed student loans are Private Education Loans.

Private Education Loans are unsecured and are not guaranteed or reinsured under the FFELP or any

other federal student loan program and are not insured by any private insurance program. Accordingly, we

bear the full risk of loss on most of these loans if the borrower and co-borrower, if applicable, defaults.

Events beyond our control such as a prolonged economic downturn could make it difficult for Private

Education Loan borrowers to meet their payment obligations for a variety of reasons, including job loss

and underemployment, which could lead to higher levels of delinquencies and defaults. Private Education

Loans now account for 25 percent of our net interest income and 13 percent of our Managed student loan

portfolio. We expect that Private Education Loans will become an increasingly higher percentage of both

our margin and our Managed student loan portfolio, which will increase the risk profile of our asset base

and raise our capital requirements because Private Education Loans have significantly higher capital

requirements than FFELP loans. This may affect the availability of capital for other purposes. In addition,

the comparatively larger spreads on Private Education Loans, which historically have compensated for the

narrowing FFELP spreads, may narrow as competition increases.

Past charge-off rates on our Private Education Loans may not be indicative of future charge-off rates because,

among other things, we use forbearance policies and our failure to adequately predict and reserve for charge-offs

may adversely impact our results of operations.

We have established forbearance policies for our Private Education Loans under which we provide to

the borrower temporary relief from payment of principal or interest in exchange for a processing fee paid

by the borrower, which is waived under certain circumstances. During the forbearance period, generally

granted in three month increments, interest that the borrower otherwise would have paid is typically

capitalized at the end of the forbearance term. At December 31, 2005, approximately 10 percent of our

Managed Private Education Loans in repayment and forbearance were in forbearance. Forbearance is

used most heavily when the borrower’s loan enters repayment; however, borrowers may apply for

forbearance multiple times and a significant number of Private Education Loan borrowers have taken

advantage of this option. When a borrower ends forbearance and enters repayment, the account is

considered current. Accordingly, a borrower who may have been delinquent in his payments or may not

have made any recent payments on his account will be accounted for as a borrower in a current repayment

status when the borrower exits the forbearance period. In addition, past charge-off rates on our Private

Education Loans may not be indicative of future charge-off rates because of, among other things, our use

of forbearance and the effect of future changes to the forbearance policies. If our forbearance policies

prove over time to be less effective on cash collections than we expect, they could have a material adverse

effect on the amount of future charge-offs and the ultimate default rate used to calculate loan loss reserves

which could have a material adverse effect on our results of operations. (See “MANAGEMENT’S