Sallie Mae 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

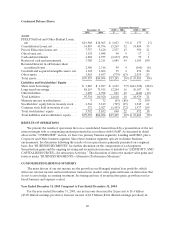

Private Education Loan principal is charged off against the allowance at 212 days delinquency.

Recoveries on loans charged off are recorded directly to the allowance.

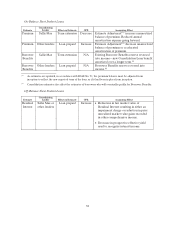

Effective for a renewable one-year period beginning in October 2005, Sallie Mae’s loan servicing

division, Sallie Mae Servicing, was designated as an Exceptional Performer (“EP”) by the U.S. Department

of Education (“ED”) in recognition of meeting certain performance standards set by ED in servicing

FFELP loans. As a result of this designation, the Company received 100 percent reimbursement (declining

to 99 percent on July 1, 2006 under new legislation discussed below) on default claims on federally

guaranteed student loans that are serviced by Sallie Mae Servicing for a period of at least 270 days before

the date of default and will no longer be subject to the two percent Risk Sharing on these loans. The

Company is entitled to receive this benefit as long as the Company remains in compliance with the

required servicing standards, which are assessed on an annual and quarterly basis through compliance

audits and other criteria. The EP designation applies to all FFELP loans that are serviced by the Company

as well as default claims on federally guaranteed student loans that the Company owns but are serviced by

other service providers with the EP designation. At December 31, 2005, approximately 92 percent of the

Company’s on-balance sheet federally insured loans are serviced under the EP designation.

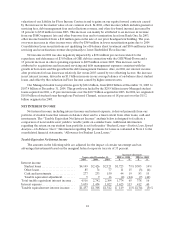

On February 8, 2006, the Reauthorization of the HEA was signed into law. (See “OTHER

RELATED EVENTS AND INFORMATION—Reauthorization” for a full update of the HEA.) The

legislation reduces the level of default insurance to 97 percent from 98 percent (effectively increasing Risk

Sharing from two percent to three percent) on loans disbursed after July 1, 2006 for lenders without the EP

designation. Furthermore, the bill reduces the default insurance paid to lenders/servicers with the EP

designation to 99 percent from 100 percent on claims filed on or after July 1, 2006. As a result of the

amended insurance levels, we established a Risk Sharing allowance as of December 31, 2005 for an

estimate of losses on FFELP student loans based on the one percent reduction in default insurance for

servicers with the EP designation. The reserve was established using a migration analysis similar to that

described above for the Private Education Loans before applying the appropriate Risk Sharing percentage.

As a result, for the year ended December 31, 2005, we provided for additional reserves of $10 million for

on-balance sheet FFELP loans and $19 million for Managed FFELP loans.

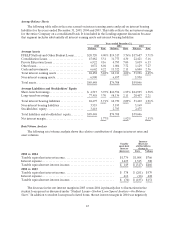

The evaluation of the provisions for loan losses is inherently subjective, as it requires material

estimates that may be susceptible to significant changes. Management believes that the allowance for loan

losses is appropriate to cover probable losses in the student loan portfolio.

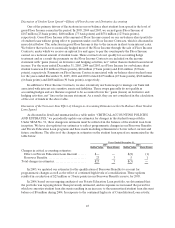

Derivative Accounting

We use interest rate swaps, foreign currency swaps, interest rate futures contracts, Floor Income

Contracts and interest rate cap contracts as an integral part of our overall risk management strategy to

manage interest rate risk arising from our fixed rate and floating rate financial instruments. We account for

these instruments in accordance with SFAS No. 133, “Accounting for Derivative Instruments and Hedging

Activities,” which requires that every derivative instrument, including certain derivative instruments

embedded in other contracts, be recorded at fair value on the balance sheet as either an asset or liability.

We determine the fair value for our derivative instruments using pricing models that consider current

market values and the contractual terms of the derivative contracts. Pricing models and their underlying

assumptions impact the amount and timing of unrealized gains and losses recognized; the use of different

pricing models or assumptions could produce different financial results. As a matter of policy, we compare

the fair values of our derivatives that we calculate to those provided by our counterparties on a monthly

basis. Any significant differences are identified and resolved appropriately.

We make certain judgments in the application of hedge accounting under SFAS No. 133. The most

significant judgment relates to the application of hedge accounting in connection with our forecasted debt

issuances. Under SFAS No. 133, if the forecasted transaction is probable to occur then hedge accounting