PNC Bank 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

before permanently restructuring the loan into a HAMP

modification. Subsequent to successful borrower performance

under the trial payment period, we will capitalize the original

contractual amount past due, to include accrued interest and

fees receivable, and restructure the loan’s contractual terms,

along with bringing the restructured account current. As the

borrower is often already delinquent at the time of

participation in the HAMP trial payment period, generally

enrollment in the program does not significantly increase the

ALLL. If the trial payment period is unsuccessful, the loan

will be evaluated for further action based upon our existing

policies.

Residential conforming and certain residential construction

loans have been permanently modified under HAMP or, if

they do not qualify for a HAMP modification, under PNC-

developed programs, which in some cases may operate

similarly to HAMP. These programs first require a reduction

of the interest rate followed by an extension of term and, if

appropriate, deferral of principal payments. As of

December 31, 2014 and December 31, 2013, 6,349 accounts

with a balance of $.9 billion and 5,834 accounts with a

balance of $.9 billion, respectively, of residential real estate

loans had been modified under HAMP and were still

outstanding on our balance sheet.

Commercial Loan Modifications and Payment Plans

Modifications of terms for commercial loans are based on

individual facts and circumstances. Commercial loan

modifications may involve reduction of the interest rate,

extension of the loan term and/or forgiveness of principal.

Modified commercial loans are usually already nonperforming

prior to modification. We evaluate these modifications for

TDR classification based upon whether we granted a

concession to a borrower experiencing financial difficulties.

Additional detail on TDRs is discussed below as well as in

Note 3 Asset Quality in the Notes To Consolidated Financial

Statements of this Report.

We have established certain commercial loan modification

and payment programs for small business loans, Small

Business Administration loans, and investment real estate

loans. As of December 31, 2014 and December 31, 2013, $34

million and $47 million, respectively, in loan balances were

covered under these modification and payment plan programs.

Of these loan balances, $12 million and $16 million have been

determined to be TDRs as of December 31, 2014 and

December 31, 2013, respectively.

Troubled Debt Restructurings

A TDR is a loan whose terms have been restructured in a

manner that grants a concession to a borrower experiencing

financial difficulties. TDRs result from our loss mitigation

activities and include rate reductions, principal forgiveness,

postponement/reduction of scheduled amortization and

extensions, which are intended to minimize economic loss and

to avoid foreclosure or repossession of collateral.

Additionally, TDRs also result from borrowers that have been

discharged from personal liability through Chapter 7

bankruptcy and have not formally reaffirmed their loan

obligations to PNC. For the twelve months ended

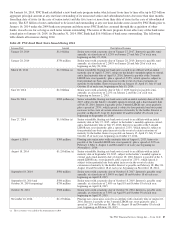

December 31, 2014, $1.2 billion of Consumer loans held for

sale, loans accounted for under the fair value option and

pooled purchased impaired loans, as well as certain

government insured or guaranteed loans, were excluded from

the TDR population. The comparable amount for the twelve

months ended December 31, 2013 was $2.3 billion.

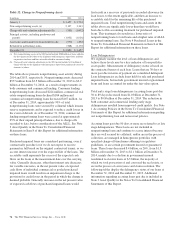

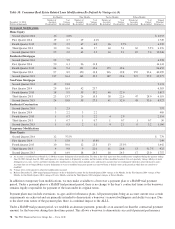

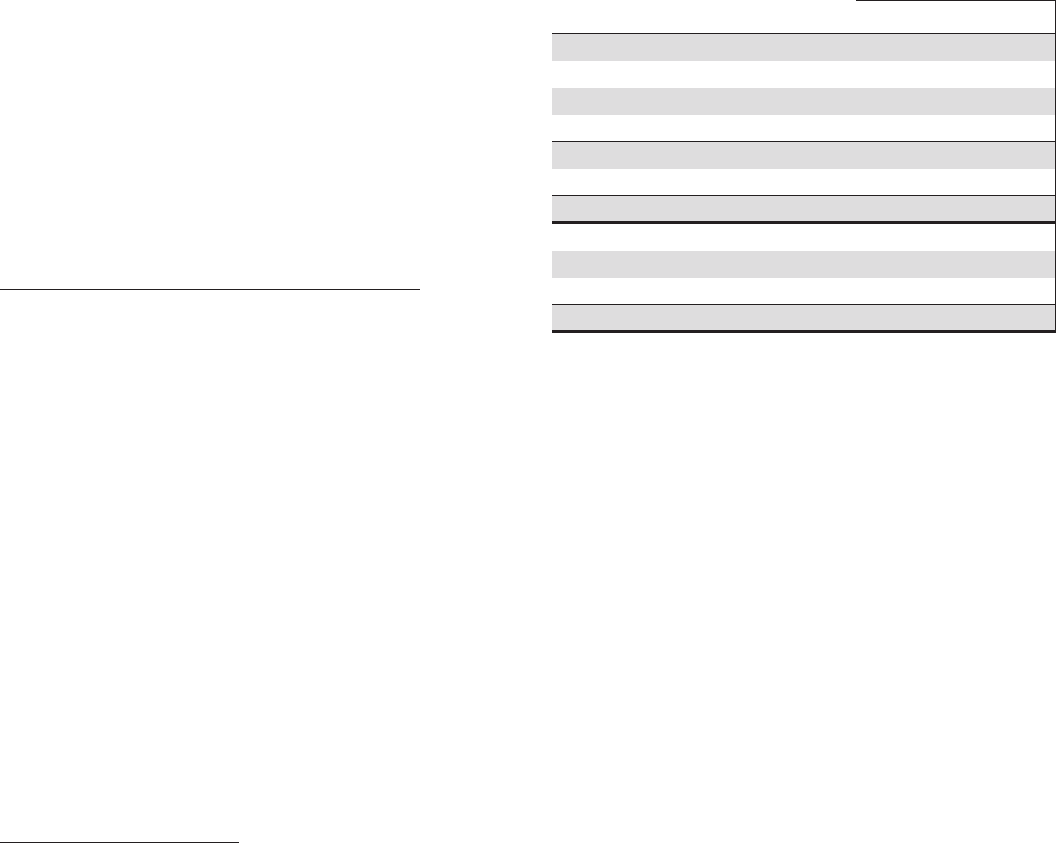

Table 39: Summary of Troubled Debt Restructurings (a)

In millions

December 31

2014

December 31

2013

Consumer lending:

Real estate-related $1,864 $1,939

Credit card 130 166

Other consumer 47 56

Total consumer lending 2,041 2,161

Total commercial lending 542 578

Total TDRs $2,583 $2,739

Nonperforming $1,370 $1,511

Accruing (b) 1,083 1,062

Credit card 130 166

Total TDRs $2,583 $2,739

(a) Amounts in table represent recorded investment, which includes the unpaid principal

balance plus accrued interest and net accounting adjustments, less any charge-offs.

Recorded investment does not include any associated valuation allowance.

(b) Accruing loans have demonstrated a period of at least six months of performance

under the restructured terms and are excluded from nonperforming loans. Loans

where borrowers have been discharged from personal liability through Chapter 7

bankruptcy and have not formally reaffirmed their loan obligations to PNC and

loans to borrowers not currently obligated to make principal and interest payments

under the restructured terms are not returned to accrual status.

Total TDRs decreased $156 million, or 6%, during 2014.

Nonperforming TDRs totaled $1.4 billion, which represents

approximately 55% of total nonperforming loans, and 53% of

total TDRs.

TDRs that are performing, including credit card loans, are

excluded from nonperforming loans. These TDRs decreased $15

million, or 1%, during 2014 to $1.2 billion as of December 31,

2014. Generally, the accruing category is comprised of loans

where borrowers have been performing under the restructured

terms for at least six consecutive months. Loans where

borrowers have been discharged from personal liability through

Chapter 7 bankruptcy and have not formally reaffirmed their

loan obligations to PNC and loans to borrowers not currently

obligated to make both principal and interest payments under the

restructured terms are not returned to accrual status. See Note 3

Asset Quality in the Notes To Consolidated Financial Statements

in this Report for additional information.

The PNC Financial Services Group, Inc. – Form 10-K 79