PNC Bank 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

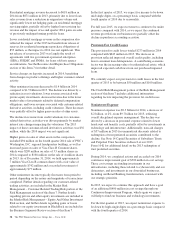

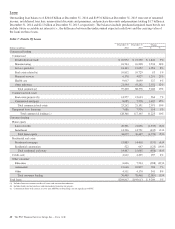

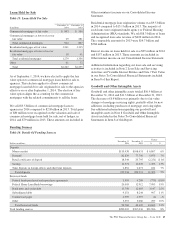

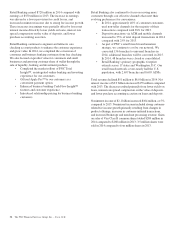

Loans Held for Sale

Table 15: Loans Held For Sale

In millions

December 31

2014

December 31

2013

Commercial mortgages at fair value $ 893 $ 586

Commercial mortgages at lower of cost or

fair value 29 281

Total commercial mortgages 922 867

Residential mortgages at fair value 1,261 1,315

Residential mortgages at lower of cost or

fair value 18 41

Total residential mortgages 1,279 1,356

Other 61 32

Total $2,262 $2,255

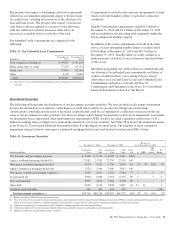

As of September 1, 2014, we have elected to apply the fair

value option to commercial mortgage loans held for sale to

agencies. This election applies to all new commercial

mortgage loans held for sale originated for sale to the agencies

effective on or after September 1, 2014. The election of fair

value option aligns the accounting for the commercial

mortgages with the related commitments to sell the loans.

We sold $3.5 billion of commercial mortgage loans to

agencies in 2014 compared to $2.8 billion in 2013. Total gains

of $80 million were recognized on the valuation and sale of

commercial mortgage loans held for sale, net of hedges, in

2014, and $79 million in 2013. These amounts are included in

Other noninterest income on our Consolidated Income

Statement.

Residential mortgage loan origination volume was $9.5 billion

in 2014 compared to $15.1 billion in 2013. The majority of

such loans were originated under agency or Federal Housing

Administration (FHA) standards. We sold $8.3 billion of loans

and recognized loan sales revenue of $420 million in 2014.

The comparable amounts for 2013 were $14.7 billion and

$568 million.

Interest income on loans held for sale was $99 million in 2014

and $157 million in 2013. These amounts are included in

Other interest income on our Consolidated Income Statement.

Additional information regarding our loan sale and servicing

activities is included in Note 2 Loan Sale and Servicing

Activities and Variable Interest Entities and Note 7 Fair Value

in our Notes To Consolidated Financial Statements included

in Item 8 of this Report.

Goodwill and Other Intangible Assets

Goodwill and other intangible assets totaled $10.9 billion at

December 31, 2014 and $11.3 billion at December 31, 2013.

The decrease of $.4 billion was primarily due to fair value

changes of mortgage servicing rights, partially offset by new

additions, including purchases of mortgage servicing rights.

See additional information regarding our goodwill and

intangible assets in Note 8 Goodwill and Other Intangible

Assets included in the Notes To Consolidated Financial

Statements in Item 8 of this Report.

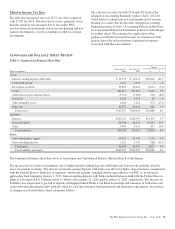

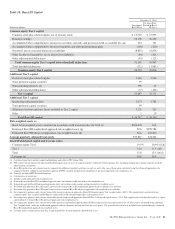

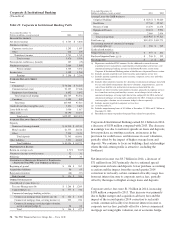

Funding Sources

Table 16: Details Of Funding Sources

Dollars in millions

December 31

2014

December 31

2013

Change

$%

Deposits

Money market $115,438 $108,631 $ 6,807 6%

Demand 82,829 77,756 5,073 7%

Retail certificates of deposit 18,544 20,795 (2,251) (11)%

Savings 12,571 11,078 1,493 13%

Time deposits in foreign offices and other time deposits 2,852 2,671 181 7%

Total deposits 232,234 220,931 11,303 5%

Borrowed funds

Federal funds purchased and repurchase agreements 3,510 4,289 (779) (18)%

Federal Home Loan Bank borrowings 20,005 12,912 7,093 55%

Bank notes and senior debt 15,750 12,603 3,147 25%

Subordinated debt 9,151 8,244 907 11%

Commercial paper 4,995 4,997 (2) –%

Other 3,357 3,060 297 10%

Total borrowed funds 56,768 46,105 10,663 23%

Total funding sources $289,002 $267,036 $21,966 8%

The PNC Financial Services Group, Inc. – Form 10-K 45