PNC Bank 2014 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

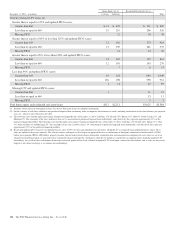

significantly impact the economic performance of the entity.

However, certain partnership or LLC agreements provide the

limited partner or non-managing member the ability to remove

the general partner or managing member without cause. This

results in the limited partner or non-managing member being

the party that has the right to make decisions that will most

significantly impact the economic performance of the entity.

The primary sources of benefits for these investments are the

tax credits and passive losses which reduce our tax liability.

We have consolidated investments in which we have the

power to direct the activities that most significantly impact the

entity’s performance, and have an obligation to absorb

expected losses or receive benefits that could be potentially

significant. The assets are primarily included in Equity

investments and Other assets on our Consolidated Balance

Sheet with the liabilities classified in Other borrowed funds,

Accrued expenses, and Other liabilities and the third-party

investors’ interests included in the Equity section as

Noncontrolling interests. Neither creditors nor equity investors

in these investments have any recourse to our general credit.

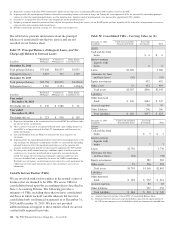

The consolidated assets and liabilities of these investments are

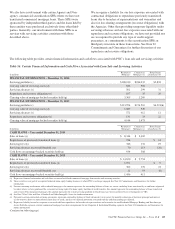

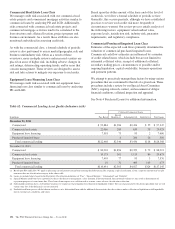

provided in Table 58 and are reflected in the “Other” business

segment.

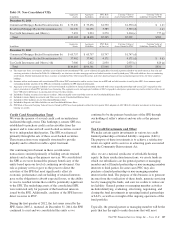

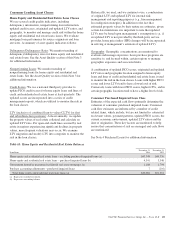

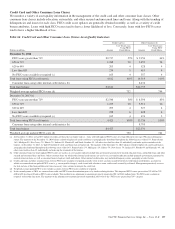

For tax credit investments in which we do not have the right to

make decisions that will most significantly impact the

economic performance of the entity, we are not the primary

beneficiary and thus they are not consolidated. These

investments are disclosed in Table 59. The table also reflects

our maximum exposure to loss exclusive of any potential tax

credit recapture. Our maximum exposure to loss is equal to

our legally binding equity commitments adjusted for recorded

impairment, partnership results, or amortization for qualifying

low income housing tax credit investments when applicable.

For all legally binding unfunded equity commitments, we

increase our recognized investment and recognize a liability.

As of December 31, 2014, we had a liability of $441 million

related to investments in qualified affordable housing projects

which is reflected in Other liabilities on our Consolidated

Balance Sheet.

Table 59 also includes our involvement in lease financing

transactions with LLCs engaged in solar power generation that

to a large extent provided returns in the form of tax credits.

The outstanding financings and operating lease assets are

reflected as Loans and Other assets, respectively, on our

Consolidated Balance Sheet, whereas related liabilities are

reported in Deposits and Other liabilities.

Residential and Commercial Mortgage-Backed

Securitizations

In connection with each Agency and Non-agency

securitization discussed above, we evaluate each SPE utilized

in these transactions for consolidation. In performing these

assessments, we evaluate our level of continuing involvement

in these transactions as the nature of our involvement

ultimately determines whether or not we hold a variable

interest and/or are the primary beneficiary of the SPE. Factors

we consider in our consolidation assessment include the

significance of (i) our role as servicer, (ii) our holdings of

mortgage-backed securities issued by the securitization SPE,

and (iii) the rights of third-party variable interest holders.

The first step in our assessment is to determine whether we

hold a variable interest in the securitization SPE. We hold

variable interests in Agency and Non-agency securitization

SPEs through our holding of mortgage-backed securities

issued by the SPEs and/or our recourse obligations. Each SPE

in which we hold a variable interest is evaluated to determine

whether we are the primary beneficiary of the entity. For

Agency securitization transactions, our contractual role as

servicer does not give us the power to direct the activities that

most significantly affect the economic performance of the

SPEs. Thus, we are not the primary beneficiary of these

entities. For Non-agency securitization transactions, we would

be the primary beneficiary to the extent our servicing activities

give us the power to direct the activities that most

significantly affect the economic performance of the SPE and

we hold a more than insignificant variable interest in the

entity.

Details about the Agency and Non-agency securitization SPEs

where we hold a variable interest and are not the primary

beneficiary are included in Table 59. Our maximum exposure

to loss as a result of our involvement with these SPEs is the

carrying value of the mortgage-backed securities, servicing

assets, servicing advances, and our liabilities associated with

our recourse obligations. Creditors of the securitization SPEs

have no recourse to PNC’s assets or general credit.

N

OTE

3A

SSET

Q

UALITY

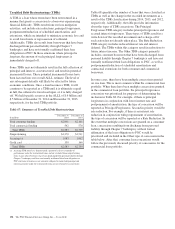

Asset Quality

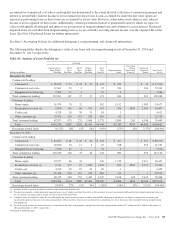

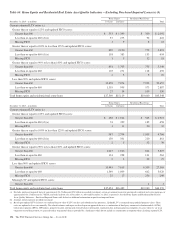

We closely monitor economic conditions and loan

performance trends to manage and evaluate our exposure to

credit risk. Trends in delinquency rates may be a key

indicator, among other considerations, of credit risk within the

loan portfolios. The measurement of delinquency status is

based on the contractual terms of each loan. Loans that are 30

days or more past due in terms of payment are considered

delinquent. Loan delinquencies exclude loans held for sale,

purchased impaired loans, nonperforming loans and loans

accounted for under the fair value option which are on

nonaccrual status, but include government insured or

guaranteed loans and accruing loans accounted for under the

fair value option.

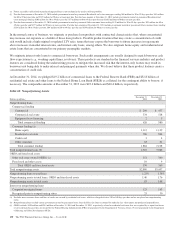

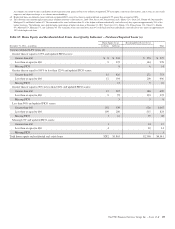

The trends in nonperforming assets represent another key

indicator of the potential for future credit losses.

Nonperforming assets include nonperforming loans, OREO

and foreclosed assets. Nonperforming loans are those loans

128 The PNC Financial Services Group, Inc. – Form 10-K