PNC Bank 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

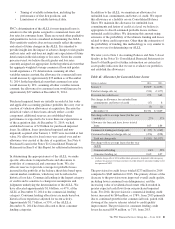

through Chapter 7 bankruptcy and have not formally

reaffirmed their loan obligations to PNC and loans to

borrowers not currently obligated to make both principal and

interest payments under the restructured terms are not returned

to accrual status.

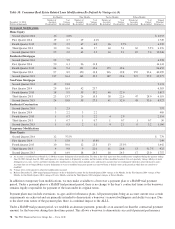

At December 31, 2014, our largest nonperforming asset was

$35 million in the Real Estate, Rental and Leasing Industry

and our average nonperforming loans associated with

commercial lending were under $1 million. All of the ten

largest outstanding nonperforming assets are from the

commercial lending portfolio and represent 21% and 4% of

total commercial lending nonperforming loans and total

nonperforming assets, respectively, as of December 31, 2014.

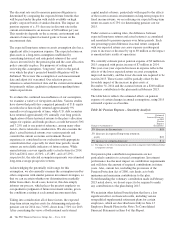

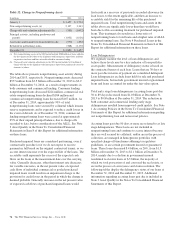

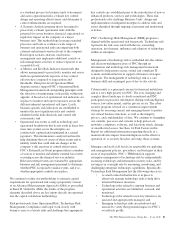

Table 30: Nonperforming Assets By Type

Dollars in millions

December 31

2014

December 31

2013

Nonperforming loans

Commercial lending

Commercial

Retail/wholesale trade $ 48 $ 57

Manufacturing 59 58

Service providers 67 108

Real estate related (a) 66 124

Financial services 4 7

Health care 28 19

Other industries 18 84

Total commercial 290 457

Commercial real estate

Real estate projects (b) 290 436

Commercial mortgage 44 82

Total commercial real estate 334 518

Equipment lease financing 2 5

Total commercial lending 626 980

Consumer lending (c)

Home equity 1,112 1,139

Residential real estate

Residential mortgage 694 890

Residential construction 12 14

Credit card 3 4

Other consumer 63 61

Total consumer lending 1,884 2,108

Total nonperforming loans (d) 2,510 3,088

OREO and foreclosed assets

Other real estate owned (OREO) (e) 351 360

Foreclosed and other assets 19 9

Total OREO and foreclosed

assets 370 369

Total nonperforming assets $2,880 $3,457

Amount of TDRs included in nonperforming

loans $1,370 $1,511

Percentage of total nonperforming loans 55% 49%

Nonperforming loans to total loans 1.23% 1.58%

Nonperforming assets to total loans, OREO

and foreclosed assets 1.40 1.76

Nonperforming assets to total assets 0.83 1.08

Allowance for loan and lease losses to total

nonperforming loans (f) 133 117

(a) Includes loans related to customers in the real estate and construction industries.

(b) Includes both construction loans and intermediate financing for projects.

(c) Excludes most consumer loans and lines of credit, not secured by residential real

estate, which are charged off after 120 to 180 days past due and are not placed on

nonperforming status.

(d) Nonperforming loans exclude certain government insured or guaranteed loans, loans

held for sale, loans accounted for under the fair value option and purchased impaired

loans.

(e) OREO excludes $194 million and $245 million at December 31, 2014 and

December 31, 2013, respectively, related to commercial and residential real estate

that was acquired by us upon foreclosure of serviced loans because they are insured

by the FHA or guaranteed by the VA or guaranteed by the Department of Housing

and Urban Development.

(f) The allowance for loan and lease losses includes impairment reserves attributable to

purchased impaired loans. See Note 1 Accounting Policies and Note 5 Allowances

for Loan and Lease Losses and Unfunded Loan Commitments and Letters of Credit

in the Notes To Consolidated Financial Statements in Item 8 of this Report for

additional information.

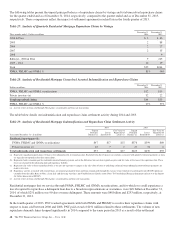

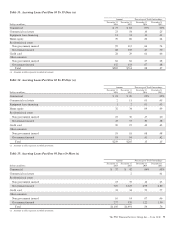

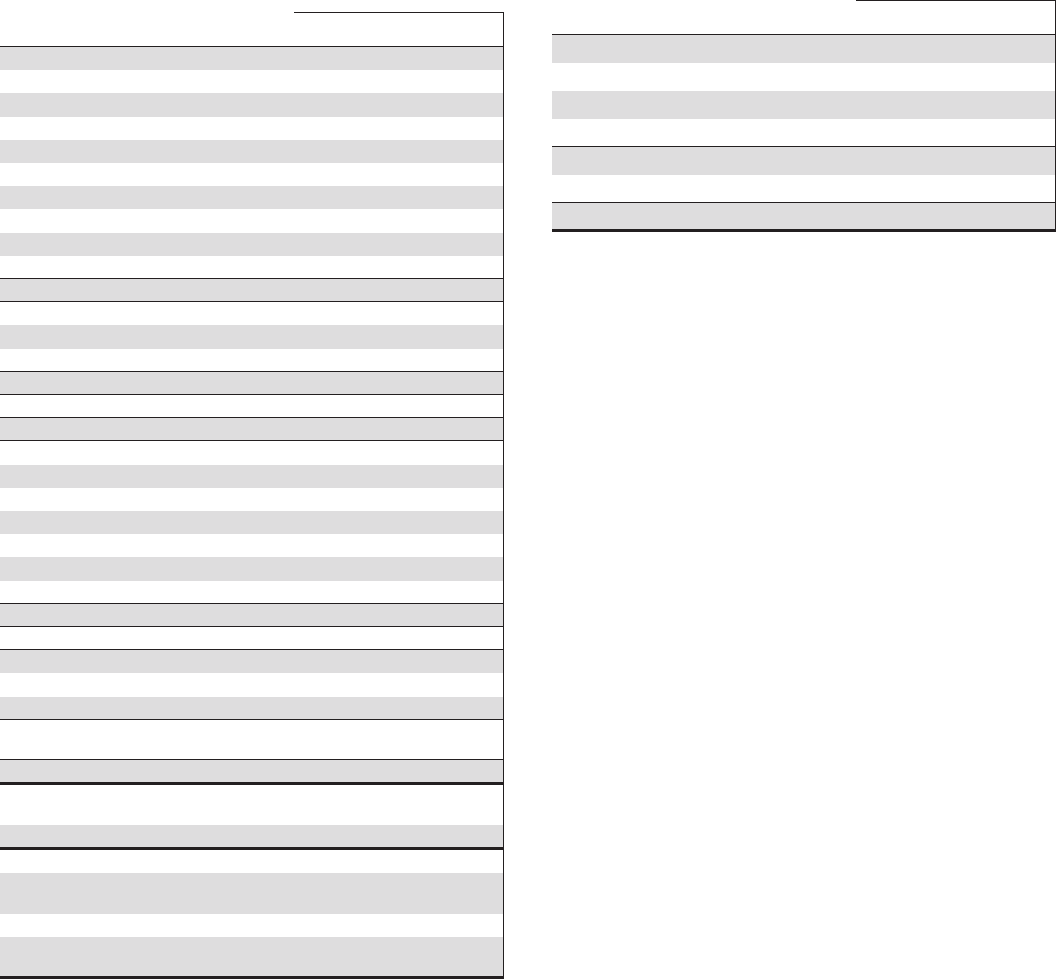

Table 31: OREO and Foreclosed Assets

In millions

December 31

2014

December 31

2013

Other real estate owned (OREO):

Residential properties $183 $164

Residential development properties 48 74

Commercial properties 120 122

Total OREO 351 360

Foreclosed and other assets 19 9

Total OREO and foreclosed assets $370 $369

Total OREO and foreclosed assets increased $1 million during

2014 from $369 million at December 31, 2013 to $370 million

at December 31, 2014 and is 13% of total nonperforming

assets at December 31, 2014. As of December 31, 2014 and

December 31, 2013, 62% and 64%, respectively, of our

OREO and foreclosed assets were comprised of residential

related properties.

The PNC Financial Services Group, Inc. – Form 10-K 73