PNC Bank 2014 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(g) Represents securities held where PNC transferred to and/or services loans for a securitization SPE and we hold securities issued by that SPE.

(h) In prior periods, the unpaid principal balance reflected the outstanding balance at the time of charge-off. During the second quarter of 2014, we corrected the outstanding principal

balance to reflect the unpaid principal balance as of the reporting date. Amounts reported in prior periods were decreased by approximately $581 million.

(i) Gains/losses recognized on sales of loans were insignificant for the periods presented.

(j) Includes government insured or guaranteed loans eligible for repurchase through the exercise of our ROAP option and loans repurchased due to breaches of origination covenants or

representations and warranties made to purchasers.

(k) Includes contractually specified servicing fees, late charges and ancillary fees.

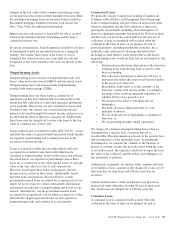

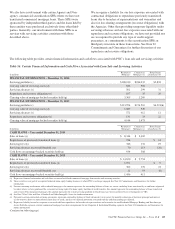

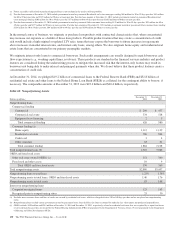

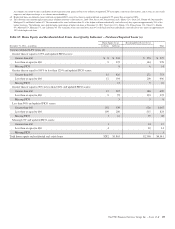

The table below presents information about the principal

balances of transferred loans that we service and are not

recorded on our balance sheet.

Table 57: Principal Balance, Delinquent Loans, and Net

Charge-offs Related to Serviced Loans

In millions

Residential

Mortgages

Commercial

Mortgages (a)

Home Equity

Loans/Lines (b)

December 31, 2014

Total principal balance $79,108 $60,873 $3,833

Delinquent loans (c) 2,657 707 1,303

December 31, 2013

Total principal balance $85,758 $62,872 $4,321(d)

Delinquent loans (c) 3,562 2,353 1,404(d)

In millions

Residential

Mortgages

Commercial

Mortgages (a)

Home Equity

Loans/Lines (b)

Year ended

December 31, 2014

Net charge-offs (e) $ 136 $ 1,288 $ 61

Year ended

December 31, 2013

Net charge-offs (e) $ 213 $ 916 $ 119

(a) Represents information at the securitization level in which PNC has sold loans and is

the servicer for the securitization.

(b) These activities were part of an acquired brokered home equity lending business in

which PNC is no longer engaged. See Note 22 Commitments and Guarantees for

further information.

(c) Serviced delinquent loans are 90 days or more past due or are in process of

foreclosure.

(d) In prior periods, the unpaid principal balance reflected the outstanding balance at the

time of charge-off. During the second quarter of 2014, we corrected the outstanding

principal balance to reflect the unpaid principal balance as of the reporting date.

Amounts reported in prior periods were decreased by approximately $581 million.

(e) Net charge-offs for Residential mortgages and Home equity loans/lines represent

credit losses less recoveries distributed and as reported to investors during the

period. Net charge-offs for Commercial mortgages represent credit losses less

recoveries distributed and as reported by the trustee for CMBS securitizations.

Realized losses for Agency securitizations are not reflected as we do not manage the

underlying real estate upon foreclosure and, as such, do not have access to loss

information.

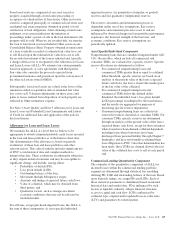

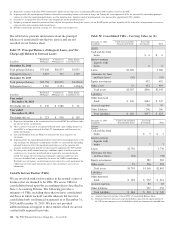

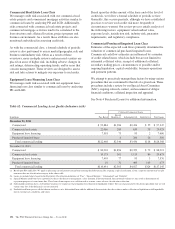

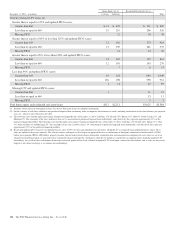

Variable Interest Entities (VIEs)

We are involved with various entities in the normal course of

business that are deemed to be VIEs. We assess VIEs for

consolidation based upon the accounting policies described in

Note 1 Accounting Policies. The following provides a

summary of VIEs, including those that we have consolidated

and those in which we hold variable interests but have not

consolidated into our financial statements as of December 31,

2014 and December 31, 2013. We have not provided

additional financial support to these entities which we are not

contractually required to provide.

Table 58: Consolidated VIEs – Carrying Value (a) (b)

December 31, 2014

In millions

Credit Card and Other

Securitization Trusts

Tax Credit

Investments Total

Assets

Cash and due from

banks $ 6 $ 6

Interest-earning

deposits with

banks 6 6

Loans $1,606 1,606

Allowance for loan

and lease losses (50) (50)

Equity investments 492 492

Other assets 31 452 483

Total assets $1,587 $956 $2,543

Liabilities

Other borrowed

funds $ 166 $181 $ 347

Accrued expenses 70 70

Other liabilities 206 206

Total liabilities $ 166 $457 $ 623

December 31, 2013

In millions

Credit Card and Other

Securitization Trusts

Tax Credit

Investments Total

Assets

Cash and due from

banks $ 5 $ 5

Interest-earning

deposits with

banks 7 7

Loans $1,736 1,736

Allowance for loan

and lease losses (58) (58)

Equity investments 582 582

Other assets 25 566 591

Total assets $1,703 $1,160 $2,863

Liabilities

Other borrowed

funds $ 184 $ 230 $ 414

Accrued expenses 83 83

Other liabilities 252 252

Total liabilities $ 184 $ 565 $ 749

(a) Amounts represent carrying value on PNC’s Consolidated Balance Sheet.

(b) Difference between total assets and total liabilities represents the equity portion of

the VIE or intercompany assets and liabilities which are eliminated in consolidation.

126 The PNC Financial Services Group, Inc. – Form 10-K