PNC Bank 2014 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We also have involvement with certain Agency and Non-

agency commercial securitization SPEs where we have not

transferred commercial mortgage loans. These SPEs were

sponsored by independent third-parties and the loans held by

these entities were purchased exclusively from other third-

parties. Generally, our involvement with these SPEs is as

servicer with servicing activities consistent with those

described above.

We recognize a liability for our loss exposure associated with

contractual obligations to repurchase previously transferred

loans due to breaches of representations and warranties and

also for loss sharing arrangements (recourse obligations) with

the Agencies. Other than providing temporary liquidity under

servicing advances and our loss exposure associated with our

repurchase and recourse obligations, we have not provided nor

are we required to provide any type of credit support,

guarantees, or commitments to the securitization SPEs or

third-party investors in these transactions. See Note 22

Commitments and Guarantees for further discussion of our

repurchase and recourse obligations.

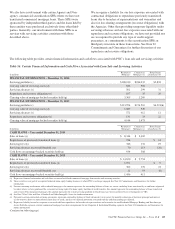

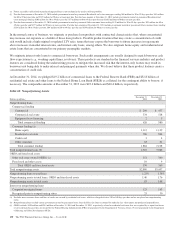

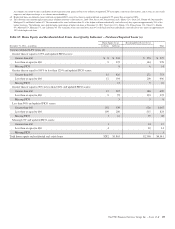

The following table provides certain financial information and cash flows associated with PNC’s loan sale and servicing activities:

Table 56: Certain Financial Information and Cash Flows Associated with Loan Sale and Servicing Activities

In millions

Residential

Mortgages

Commercial

Mortgages (a)

Home Equity

Loans/Lines (b)

FINANCIAL INFORMATION – December 31, 2014

Servicing portfolio (c) $108,010 $186,032 $3,833

Carrying value of servicing assets (d) 845 506

Servicing advances (e) 501 299 31

Repurchase and recourse obligations (f) 107 35 29

Carrying value of mortgage-backed securities held (g) 3,365 1,269

FINANCIAL INFORMATION – December 31, 2013

Servicing portfolio (c) $113,994 $176,510 $4,321(h)

Carrying value of servicing assets (d) 1,087 549

Servicing advances (e) 571 412 11

Repurchase and recourse obligations (f) 131 33 22

Carrying value of mortgage-backed securities held (g) 4,144 1,475

In millions

Residential

Mortgages

Commercial

Mortgages (a)

Home Equity

Loans/Lines (b)

CASH FLOWS – Year ended December 31, 2014

Sales of loans (i) $ 8,344 $ 3,469

Repurchases of previously transferred loans (j) 744 $ 14

Servicing fees (k) 346 132 19

Servicing advances recovered/(funded), net 70 113 (20)

Cash flows on mortgage-backed securities held (g) 934 308

CASH FLOWS – Year ended December 31, 2013

Sales of loans (i) $ 14,650 $ 2,754

Repurchases of previously transferred loans (j) 1,191 $ 9

Servicing fees (k) 362 176 21

Servicing advances recovered/(funded), net 11 93 (6)

Cash flows on mortgage-backed securities held (g) 1,456 411

(a) Represents financial information and cash flows associated with both commercial mortgage loan transfer and servicing activities.

(b) These activities were part of an acquired brokered home equity lending business in which PNC is no longer engaged. See Note 22 Commitments and Guarantees for further

information.

(c) For our continuing involvement with residential mortgages, this amount represents the outstanding balance of loans we service, including loans transferred by us and loans originated

by others where we have purchased the associated servicing rights. For home equity loan/line of credit transfers, this amount represents the outstanding balance of loans transferred

and serviced. For commercial mortgages, this amount represents our overall servicing portfolio in which loans have been transferred by us or third parties to VIEs.

(d) See Note 7 Fair Value and Note 8 Goodwill and Other Intangible Assets for further information.

(e) Pursuant to certain contractual servicing agreements, represents outstanding balance of funds advanced (i) to investors for monthly collections of borrower principal and interest,

(ii) for borrower draws on unused home equity lines of credit, and (iii) for collateral protection associated with the underlying mortgage collateral.

(f) Represents liability for our loss exposure associated with loan repurchases for breaches of representations and warranties for our Residential Mortgage Banking and Non-Strategic

Assets Portfolio segments, and our commercial mortgage loss share arrangements for our Corporate & Institutional Banking segment. See Note 22 Commitments and Guarantees for

further information.

(Continued on following page)

The PNC Financial Services Group, Inc. – Form 10-K 125