PNC Bank 2014 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

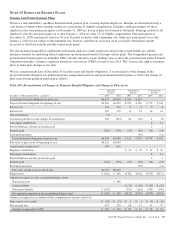

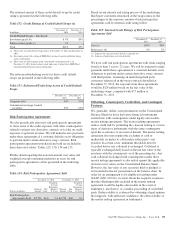

In the preceding table, the unit shares and related weighted-

average grant date fair value of the incentive/performance

awards exclude the effect of dividends on the underlying

shares, as those dividends will be paid in cash if and when the

underlying unit shares are released to the participants.

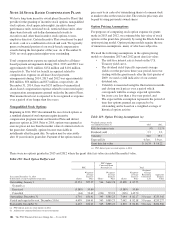

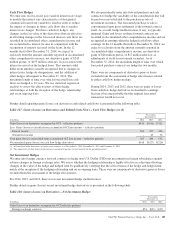

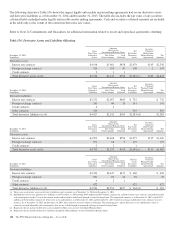

Liability Awards

A summary of all nonvested, cash-payable incentive/

performance units and restricted share unit activity follows:

Table 122: Nonvested Cash-Payable Incentive/Performance

Units and Restricted Share Units – Rollforward

In thousands

Cash-Payable

Incentive/

Performance

Units

Cash-Payable

Restricted

Share Units Total

Outstanding at December 31,

2013 116 825 941

Granted 100 269 369

Vested and Released (39) (425) (464)

Forfeited (11) (11)

Outstanding at December 31,

2014 177 658 835

Included in the preceding table are cash-payable restricted

share units granted to certain executives. These grants were

made primarily as part of an annual bonus incentive deferral

plan. While there are time-based and other vesting criteria,

there are generally no market or performance criteria

associated with these awards. Compensation expense

recognized related to these awards was recorded in prior

periods as part of the annual cash bonus process. As of

December 31, 2014, the aggregate intrinsic value of all

outstanding nonvested cash-payable incentive/performance

units and restricted share units was $76 million.

The total of all share-based liability awards paid out during

2014, 2013 and 2012 was approximately $38 million, $29

million and $39 million, respectively.

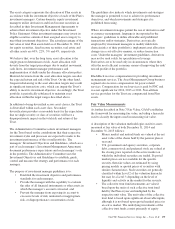

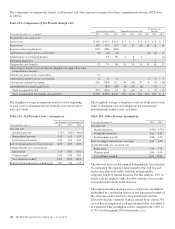

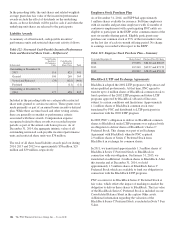

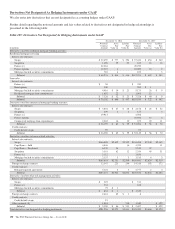

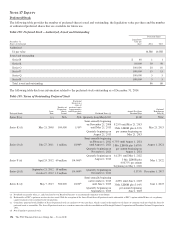

Employee Stock Purchase Plan

As of December 31, 2014, our ESPP had approximately

1 million shares available for issuance. Full-time employees

with six months and part-time employees with 12 months of

continuous employment with a participating PNC entity are

eligible to participate in the ESPP at the commencement of the

next six-month offering period. Eligible participants may

purchase our common stock at 95% of the fair market value

on the last day of each six-month offering period. No charge

to earnings is recorded with respect to the ESPP.

Table 123: Employee Stock Purchase Plan – Summary

Year ended December 31 Shares Issued Purchase Price Per Share

2014 157,856 $84.60 and $86.67

2013 167,260 $69.27 and $73.70

2012 183,892 $58.05 and $55.39

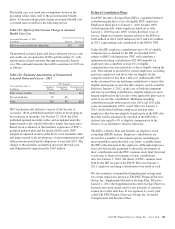

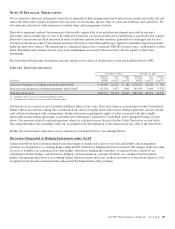

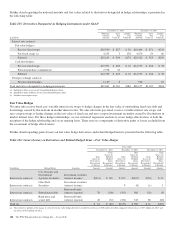

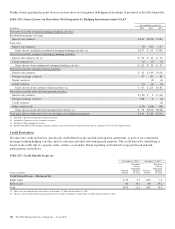

BlackRock LTIP and Exchange Agreements

BlackRock adopted the 2002 LTIP program to help attract and

retain qualified professionals. At that time, PNC agreed to

transfer up to 4 million shares of BlackRock common stock to

fund a portion of the 2002 LTIP program and future LTIP

programs approved by BlackRock’s Board of Directors,

subject to certain conditions and limitations. Approximately

1.1 million shares of BlackRock common stock were

transferred by PNC and distributed to LTIP participants in

connection with the 2002 LTIP program.

In 2009, PNC’s obligation to deliver its BlackRock common

shares to BlackRock under LTIP programs was replaced with

an obligation to deliver shares of BlackRock’s Series C

Preferred Stock. This change was part of an Exchange

Agreement with BlackRock whereby PNC acquired

2.9 million shares of Series C Preferred Stock from

BlackRock in exchange for common shares.

In 2011, we transferred approximately 1.3 million shares of

BlackRock Series C Preferred Stock to BlackRock in

connection with our obligation. On January 31, 2013, we

transferred an additional .2 million shares to BlackRock. After

this transfer and at December 31, 2014, we hold

approximately 1.3 million shares of BlackRock Series C

Preferred Stock which are available to fund our obligation in

connection with the BlackRock LTIP programs.

PNC accounts for its BlackRock Series C Preferred Stock at

fair value, which offsets the impact of marking-to-market the

obligation to deliver these shares to BlackRock. The fair value

of the BlackRock Series C Preferred Stock is included on our

Consolidated Balance Sheet in the caption Other assets.

Additional information regarding the valuation of the

BlackRock Series C Preferred Stock is included in Note 7 Fair

Value.

186 The PNC Financial Services Group, Inc. – Form 10-K