PNC Bank 2014 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

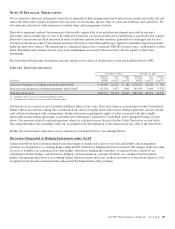

Cash Flow Hedges

We enter into receive-fixed, pay-variable interest rate swaps

to modify the interest rate characteristics of designated

commercial loans from variable to fixed in order to reduce

the impact of changes in future cash flows due to market

interest rate changes. For these cash flow hedges, any

changes in the fair value of the derivatives that are effective

in offsetting changes in the forecasted interest cash flows are

recorded in Accumulated other comprehensive income and

are reclassified to interest income in conjunction with the

recognition of interest received on the loans. In the 12

months that follow December 31, 2014, we expect to

reclassify from the amount currently reported in Accumulated

other comprehensive income, net derivative gains of $245

million pretax, or $159 million after-tax, in association with

interest received on the hedged loans. This amount could

differ from amounts actually recognized due to changes in

interest rates, hedge de-designations, and the addition of

other hedges subsequent to December 31, 2014. The

maximum length of time over which forecasted loan cash

flows are hedged is 10 years. We use statistical regression

analysis to assess the effectiveness of these hedge

relationships at both the inception of the hedge relationship

and on an ongoing basis.

We also periodically enter into forward purchase and sale

contracts to hedge the variability of the consideration that will

be paid or received related to the purchase or sale of

investment securities. The forecasted purchase or sale is

consummated upon gross settlement of the forward contract

itself. As a result, hedge ineffectiveness, if any, is typically

minimal. Gains and losses on these forward contracts are

recorded in Accumulated other comprehensive income and are

recognized in earnings when the hedged cash flows affect

earnings. In the 12 months that follow December 31, 2014, we

expect to reclassify from the amount currently reported in

Accumulated other comprehensive income, net derivative

gains of $26 million pretax, or $17 million after-tax, as

adjustments of yield on investment securities. As of

December 31, 2014, the maximum length of time over which

forecasted purchase contracts are hedged is two months.

There were no components of derivative gains or losses

excluded from the assessment of hedge effectiveness related

to either cash flow hedge strategy.

During 2014, 2013, and 2012, there were no gains or losses

from cash flow hedge derivatives reclassified to earnings

because it became probable that the original forecasted

transaction would not occur.

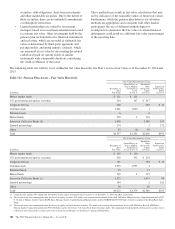

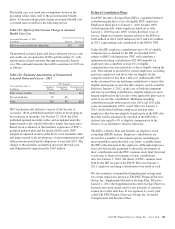

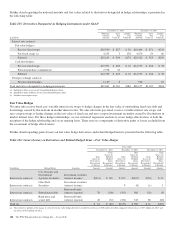

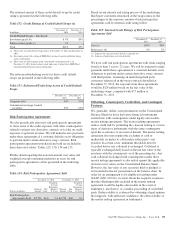

Further detail regarding gains (losses) on derivatives and related cash flows is presented in the following table:

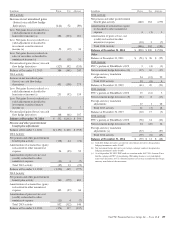

Table 127: Gains (Losses) on Derivatives and Related Cash Flows – Cash Flow Hedges (a) (b)

Year ended

December 31

In millions 2014 2013 2012

Gains (losses) on derivatives recognized in OCI – (effective portion) $431 $(141) $ 312

Less: Gains (losses) reclassified from accumulated OCI into income – (effective portion)

Interest income 263 337 456

Noninterest income –4976

Total gains (losses) reclassified from accumulated OCI into income – (effective portion) 263 386 532

Net unrealized gains (losses) on cash flow hedge derivatives $168 $(527) $(220)

(a) All cash flow hedge derivatives are interest rate contracts as of December 31, 2014, December 31, 2013 and December 31, 2012.

(b) The amount of cash flow hedge ineffectiveness recognized in income was not material for the periods presented.

Net Investment Hedges

We enter into foreign currency forward contracts to hedge non-U.S. Dollar (USD) net investments in foreign subsidiaries against

adverse changes in foreign exchange rates. We assess whether the hedging relationship is highly effective in achieving offsetting

changes in the value of the hedge and hedged item by qualitatively verifying that the critical terms of the hedge and hedged item

match at the inception of the hedging relationship and on an ongoing basis. There were no components of derivative gains or losses

excluded from the assessment of the hedge effectiveness.

For 2014, 2013, and 2012, there was no net investment hedge ineffectiveness.

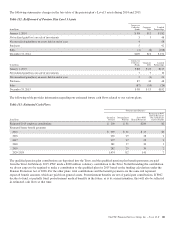

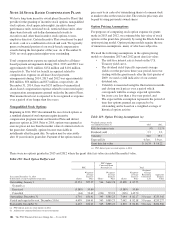

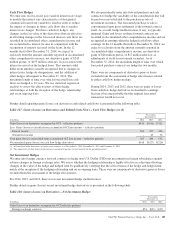

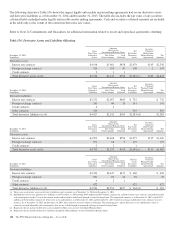

Further detail on gains (losses) on net investment hedge derivatives is presented in the following table:

Table 128: Gains (Losses) on Derivatives – Net Investment Hedges

Year ended

December 31

In millions 2014 2013 2012

Gains (losses) on derivatives recognized in OCI (effective portion)

Foreign exchange contracts $54 $(21) $(27)

The PNC Financial Services Group, Inc. – Form 10-K 189