PNC Bank 2014 Annual Report Download - page 71

Download and view the complete annual report

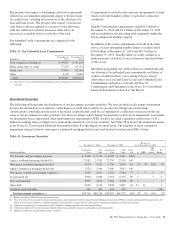

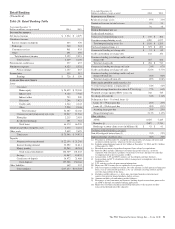

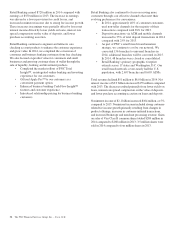

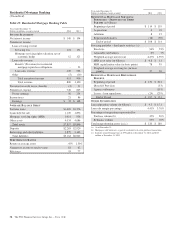

Please find page 71 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The provision for credit losses was $277 million and net

charge-offs were $458 million in 2014 compared with $657

million and $713 million, respectively, for 2013. Provision for

credit losses decreased due to improved credit metrics. The

decrease in the net charge-offs was attributable to the impact

of additional consumer charge-offs taken as a result of

alignment with interagency guidance in the first quarter of

2013 and improved credit quality during 2014.

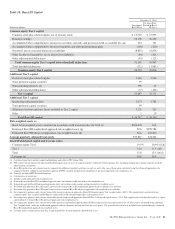

Noninterest expense of $4.6 billion was $49 million, or 1%,

higher than 2013. Increases in technology investments,

customer transaction-related costs, and non-credit losses were

offset by reduced branch network expenses as a result of

transaction migration to lower cost digital and ATM channels.

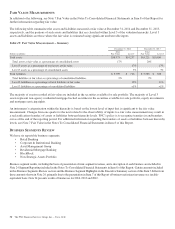

Growing core checking deposits is key to Retail Banking’s

growth and to providing a source of low-cost funding and

liquidity to PNC. The deposit product strategy of Retail Banking

is to remain disciplined on pricing, target specific products and

markets for growth, and focus on the retention and growth of

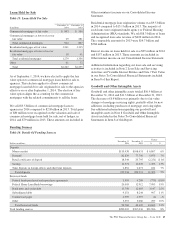

customer balances. In 2014, average total deposits of $137.2

billion increased $3.0 billion, or 2%, compared with 2013.

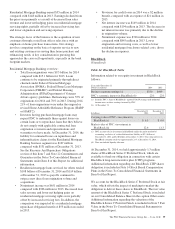

• Average transaction deposits grew $4.5 billion, or

4%, and average savings deposit balances grew $1.0

billion, or 9%, over 2013 as a result of organic

deposit growth. In 2014, average demand deposits

increased $3.1 billion, or 6%, to $56.1 billion and

average money market deposits increased $1.5

billion, or 3%, to $50.3 billion.

• Total average certificates of deposit decreased $2.5

billion, or 12%, compared to 2013. The decline in

average certificates of deposit was due to the

expected run-off of maturing accounts.

Retail Banking continued to focus on a relationship-based

lending strategy that targets specific products and markets for

growth, small businesses, and auto dealerships. In 2014,

average total loans declined $60 million to $66.2 billion as

growth in specific products was offset by declines from run-

off of non-strategic portions of the portfolios.

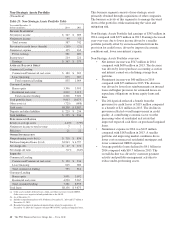

• Average indirect auto loans increased $1.4 billion, or

18%, compared to 2013. The increase was primarily

due to increases in auto sales as well as the expansion

of our indirect sales force and product introduction

into the Southeast market.

• Average credit card balances increased $222 million,

or 5%, over 2013 as a result of efforts to increase

credit card share of wallet through organic growth.

• Average auto dealer floor plan loans grew $160

million, or 8%, in 2014, primarily resulting from

sales growth and additional dealer relationships.

• Average home equity loans decreased $448 million

compared to 2013. The decrease in lines of credit of

approximately $1.0 billion was partially offset by an

increase of approximately $600 million in term loans.

The overall portfolio declines resulted from reduced

refinance activity. Retail Banking’s home equity loan

portfolio is relationship based, with 97% of the

portfolio attributable to borrowers in our primary

geographic footprint.

• Average loan balances for the remainder of the

portfolio declined a net $1.4 billion, driven by

declines in the education portfolio of $715 million

and commercial & commercial real estate of $399

million. The discontinued government guaranteed

education loan, indirect other and residential

mortgage portfolios are primarily run-off portfolios.

In December 2014 we sold $148 million of education

loans. The impacts of the sale to 2014 average loans

and earnings were not significant.

Nonperforming assets totaled $1.2 billion at December 31,

2014, a decrease of $87 million, or 7%, over 2013. The

decrease was driven by declines in both commercial and

consumer non-performing loans.

The PNC Financial Services Group, Inc. – Form 10-K 53