PNC Bank 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

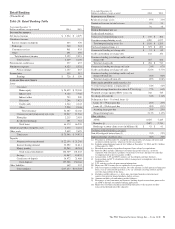

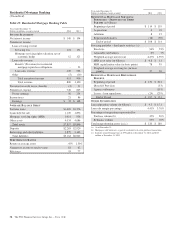

Residential Mortgage Banking earned $35 million in 2014

compared with $148 million in 2013. Earnings declined from

the prior year primarily as a result of decreased loan sales

revenue and lower net hedging gains on residential mortgage

servicing rights, partially offset by increased servicing fees

and lower origination and servicing expenses.

The strategic focus of the business is the acquisition of new

customers through a retail loan officer sales force with an

emphasis on home purchase transactions. Our strategy

involves competing on the basis of superior service to new

and existing customers in serving their home purchase and

refinancing needs. A key consideration in pursuing this

approach is the cross-sell opportunity, especially in the bank

footprint markets.

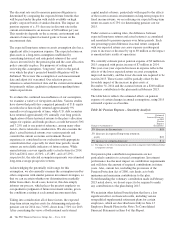

Residential Mortgage Banking overview:

• Total loan originations were $9.5 billion for 2014

compared with $15.1 billion for 2013. Loans

continue to be originated primarily through direct

channels under Federal National Mortgage

Association (FNMA), Federal Home Loan Mortgage

Corporation (FHLMC) and Federal Housing

Administration (FHA)/Department of Veterans

Affairs agency guidelines. Refinancings were 55% of

originations for 2014 and 70% in 2013. During 2014,

21% of loan originations were under the original or

revised Home Affordable Refinance Program (HARP

or HARP 2).

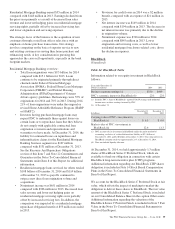

• Investors having purchased mortgage loans may

request PNC to indemnify them against losses on

certain loans or to repurchase loans that they believe

do not comply with applicable contractual loan

origination covenants and representations and

warranties we have made. At December 31, 2014, the

liability for estimated losses on repurchase and

indemnification claims for the Residential Mortgage

Banking business segment was $107 million

compared with $131 million at December 31, 2013.

See the Recourse And Repurchase Obligations

section of this Item 7 and Note 22 Commitments and

Guarantees in the Notes To Consolidated Financial

Statements under Item 8 of this Report for additional

information.

• Residential mortgage loans serviced for others totaled

$108 billion at December 31, 2014 and $114 billion

at December 31, 2013 as payoffs continued to

outpace new direct loan origination volume and

acquisitions.

• Noninterest income was $651 million in 2014

compared with $906 million in 2013. Decreased loan

sales revenue and lower net hedging gains on

residential mortgage servicing rights were partially

offset by increased servicing fees. In addition, the

comparison was impacted by a residential mortgage

repurchase obligation benefit of $53 million recorded

in 2013.

• Provision for credit losses in 2014 was a $2 million

benefit, compared with an expense of $21 million in

2013.

• Net interest income was $149 million in 2014

compared with $194 million in 2013. The decrease in

net interest income was primarily due to the decline

in origination volume.

• Noninterest expense was $746 million in 2014

compared with $845 million in 2013. Lower

origination and servicing costs, as well as lower

residential mortgage foreclosure-related costs, drove

the decline in expenses.

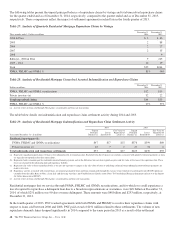

BlackRock

(Unaudited)

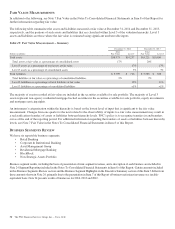

Table 24: BlackRock Table

Information related to our equity investment in BlackRock

follows:

Year ended December 31

Dollars in millions 2014 2013

Business segment earnings (a) $530 $469

PNC’s economic interest in BlackRock (b) 22% 22%

(a) Includes PNC’s share of BlackRock’s reported GAAP earnings and additional

income taxes on those earnings incurred by PNC.

(b) At December 31.

In billions

December 31

2014

December 31

2013

Carrying value of PNC’s investment in

BlackRock (c) $ 6.3 $ 6.0

Market value of PNC’s investment in

BlackRock (d) 12.6 11.3

(c) PNC accounts for its investment in BlackRock under the equity method of

accounting, exclusive of a related deferred tax liability of $2.1 billion at

December 31, 2014 and $2.0 billion at December 31, 2013. Our voting interest in

BlackRock common stock was approximately 21% at December 31, 2014.

(d) Does not include liquidity discount.

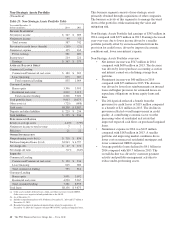

At December 31, 2014, we held approximately 1.3 million

shares of BlackRock Series C Preferred Stock, which are

available to fund our obligation in connection with certain

BlackRock long-term incentive plan (LTIP) programs.

Additional information regarding our BlackRock LTIP shares

obligation is included in Note 14 Stock Based Compensation

Plans in the Notes To Consolidated Financial Statements in

Item 8 of this Report.

We account for the BlackRock Series C Preferred Stock at fair

value, which offsets the impact of marking-to-market the

obligation to deliver these shares to BlackRock. The fair value

amount of the BlackRock Series C Preferred Stock is included

on our Consolidated Balance Sheet in the caption Other assets.

Additional information regarding the valuation of the

BlackRock Series C Preferred Stock is included in Note 7 Fair

Value in the Notes To Consolidated Financial Statements in

Item 8 of this Report.

The PNC Financial Services Group, Inc. – Form 10-K 59