PNC Bank 2014 Annual Report Download - page 252

Download and view the complete annual report

Please find page 252 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

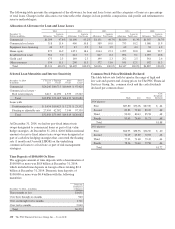

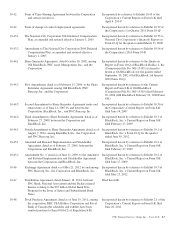

for a given period (generally a year) for each individual plan

participant of 0.2% of incentive income for that period.

Incentive income is based on PNC’s consolidated pre-tax net

income as further adjusted for the impact of changes in tax

law, extraordinary items, discontinued operations, acquisition

and merger integration costs, and for the impact of PNC’s

obligation to fund a portion of certain BlackRock long-term

incentive programs. Although the size of awards under the

plan is dollar-denominated, payment may be made in cash, in

shares of PNC common stock, or in a combination of cash and

stock.

Note 7 – The purchase price for shares of PNC common stock

sold under the plan represents 95% of the fair market value on

the last day of each six-month offering period.

Note 8 – The plans in this section of the table reflect awards

under pre-acquisition plans of National City Corporation and

Sterling Financial Corporation, respectively. National City

was merged into PNC on December 31, 2008 and Sterling was

merged into PNC on April 4, 2008. Pursuant to the respective

merger agreements for these acquisitions, common shares of

National City or Sterling, as the case may be, issuable upon

the exercise or settlement of various equity awards granted

under the National City or Sterling plans were converted into

corresponding awards covering PNC common stock.

Additional information is included in Note 14 Stock Based

Compensation Plans in the Notes To Consolidated Financial

Statements in Item 8 of this Report and in Note 16 Stock

Based Compensation Plans in the Notes To Consolidated

Financial Statements in Item 8 of our 2008 10-K.

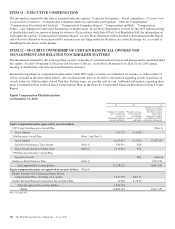

ITEM 13 – CERTAIN RELATIONSHIPS AND

RELATED TRANSACTIONS, AND

DIRECTOR INDEPENDENCE

The information required by this item is included under the

captions “Director and Executive Officer Relationships –

Director independence, – Transactions with directors, –

Family relationships, – Indemnification and advancement of

costs, and – Related person transactions policies and

procedures” in our Proxy Statement to be filed for the 2015

annual meeting of shareholders and is incorporated herein by

reference.

ITEM 14 – PRINCIPAL ACCOUNTING FEES

AND SERVICES

The information required by this item is included under the

caption “Ratification of Independent Registered Public

Accounting Firm (Item 2) – Audit, audit-related and permitted

non-audit fees” in our Proxy Statement to be filed for the 2015

annual meeting of shareholders and is incorporated herein by

reference.

PART IV

ITEM 15 – EXHIBITS, FINANCIAL

STATEMENT SCHEDULES

F

INANCIAL

S

TATEMENTS

,F

INANCIAL

S

TATEMENT

S

CHEDULES

Our consolidated financial statements required in response to

this Item are incorporated by reference from Item 8 of this

Report.

Audited consolidated financial statements of BlackRock, Inc.

as of December 31, 2014 and 2013 and for each of the three

years in the period ended December 31, 2014 are filed with

this Report as Exhibit 99.1 and incorporated herein by

reference.

E

XHIBITS

Our exhibits listed on the Exhibit Index on pages E-1 through

E-8 of this Form 10-K are filed with this Report or are

incorporated herein by reference.

234 The PNC Financial Services Group, Inc. – Form 10-K