PNC Bank 2014 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

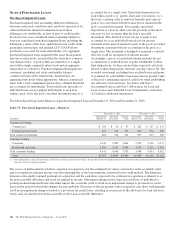

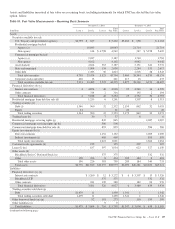

Based on current interest rates and expected prepayment

speeds, the weighted-average expected maturity of the

investment securities portfolio (excluding corporate stocks

and other) was 4.3 years at December 31, 2014 and 4.9 years

at December 31, 2013. The weighted-average expected

maturities of mortgage and other asset-backed debt securities

were as follows as of December 31, 2014:

Table 81: Weighted-Average Expected Maturity of Mortgage

and Other Asset-Backed Debt Securities

December 31, 2014 Years

Agency residential mortgage-backed securities 3.6

Non-agency residential mortgage-backed securities 5.4

Agency commercial mortgage-backed securities 3.4

Non-agency commercial mortgage-backed securities 3.2

Asset-backed securities 3.4

Weighted-average yields are based on historical cost with

effective yields weighted for the contractual maturity of each

security. At December 31, 2014, there were no securities of a

single issuer, other than FNMA, that exceeded 10% of Total

shareholders’ equity.

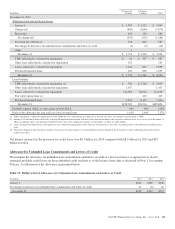

The following table presents the fair value of securities that

have been either pledged to or accepted from others to

collateralize outstanding borrowings.

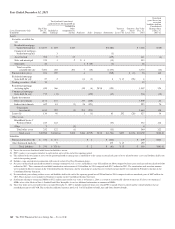

Table 82: Fair Value of Securities Pledged and Accepted as

Collateral

In millions

December 31

2014

December 31

2013

Pledged to others (a) $10,874 $12,572

Accepted from others:

Permitted by contract or custom

to sell or repledge 1,658 1,571

Permitted amount repledged to others 1,488 1,343

(a) In the prior period, the pledged to others balance incorrectly included FHLB standby

letters of credit. During the fourth quarter of 2014, we corrected the pledged to

others balance to exclude the FHLB standby letters of credit. Accordingly, the prior

period amount as of December 31, 2013 was reduced by $6.2 billion.

The securities pledged to others include positions held in our

portfolio of investment securities, trading securities, and

securities accepted as collateral from others that we are

permitted by contract or custom to sell or repledge, and were

used to secure public and trust deposits, repurchase

agreements, and for other purposes.

N

OTE

7F

AIR

V

ALUE

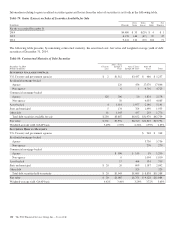

Fair Value Measurement

Fair value is defined in GAAP as the price that would be

received to sell an asset or the price that would be paid to

transfer a liability on the measurement date. GAAP focuses on

the exit price in the principal or most advantageous market for

the asset or liability in an orderly transaction between market

participants. GAAP establishes a fair value reporting hierarchy

to maximize the use of observable inputs when measuring fair

value and defines the three levels of inputs as noted below.

Level 1

Fair value is determined using a quoted price in an active

market for identical assets or liabilities. Level 1 assets and

liabilities may include debt securities, equity securities and

listed derivative contracts that are traded in an active exchange

market and certain U.S. Treasury securities that are actively

traded in over-the-counter markets.

Level 2

Fair value is estimated using inputs other than quoted prices

included within Level 1 that are observable for assets or

liabilities, either directly or indirectly. The majority of Level 2

assets and liabilities include debt securities, equity securities

and listed derivative contracts with quoted prices that are

traded in markets that are not active, and certain debt and

equity securities and over-the-counter derivative contracts

whose fair value is determined using a pricing model without

significant unobservable inputs.

Level 3

Fair value is estimated using unobservable inputs that are

significant to the fair value of the assets or liabilities. Level 3

assets and liabilities include financial instruments whose value

is determined using pricing models and discounted cash flow

methodologies, or similar techniques for which the significant

valuation inputs are not observable and the determination of fair

value requires significant management judgment or estimation.

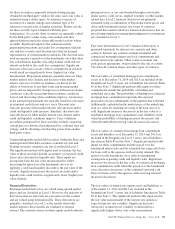

Certain assets which have been adjusted due to impairment are

accounted for at lower of amortized cost or fair value on a

nonrecurring basis and consist primarily of certain nonaccrual

loans, loans held for sale, commercial mortgage servicing

rights (in years prior to 2014), equity investments and other

assets. These assets, which are generally classified as Level 3,

are included in Table 86 in this Note 7.

We characterize active markets as those where transaction

volumes are sufficient to provide objective pricing

information, with reasonably narrow bid/ask spreads and

where dealer quotes received do not vary widely and are based

on current information. Inactive markets are typically

characterized by low transaction volumes, price quotations

that vary substantially among market participants or are not

based on current information, wide bid/ask spreads, a

The PNC Financial Services Group, Inc. – Form 10-K 151