PNC Bank 2014 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

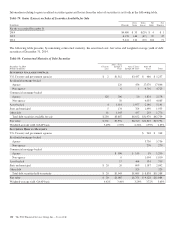

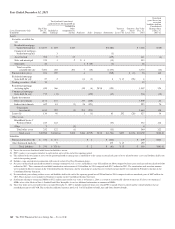

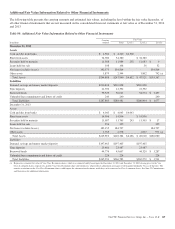

Year Ended December 31, 2013

Total realized / unrealized

gains or losses for the period (a)

Unrealized

gains (losses) on

assets and

liabilities held on

Consolidated

Balance Sheet

at Dec. 31,

2013 (c)

Level 3 Instruments Only

In millions

Fair Value

Dec. 31,

2012

Included in

Earnings

Included in

Other

comprehensive

income Purchases Sales Issuances Settlements

Transfers

into

Level 3 (b)

Transfers

out of

Level 3 (b)

Fair Value

Dec. 31,

2013

Assets

Securities available for

sale

Residential mortgage-

backed non-agency $ 6,107 $ 189 $147 $(1,085) $ 5,358 $ (10)

Commercial mortgage-

backed non-agency 3 (3)

Asset-backed 708 9 53 (129) 641 (6)

State and municipal 339 1 2 $ 4 (13) 333

Other debt 48 3 $ (10) (3) 38

Total securities

available for sale 7,202 202 202 7 (10) (1,233) 6,370 (16)

Financial derivatives 106 297 4 (369) $ (2) 36 166

Residential mortgage

loans held for sale 27 2 61 (3) 4 $ 13 (96) 8 2

Trading securities – Debt 32 32

Residential mortgage

servicing rights 650 366 110 (4) $158 (193) 1,087 354

Commercial mortgage

loans held for sale 772 (11) (130) (45) 586 (12)

Equity investments

Direct investments 1,171 141 177 (420) 1,069 62

Indirect investments 642 81 (3) 26 (151) 595 76

Total equity

investments 1,813 222 (3) 203 (571) 1,664 138

Loans (h) 134 46 1 (1) 83 292 (28) 527 34

Other assets

BlackRock Series C

Preferred Stock 243 122 (33) 332 122

Other 9 (1) 8

Total other assets 252 122 (1) (33) 340 122

Total assets $10,988 $1,246 (e) $198 $386 $(719) $158 $(1,786) $305 $(126) $10,650 $788 (f)

Liabilities

Financial derivatives (d) $ 376 $ 317 $ 2 $ (256) $ 439 $181

Other borrowed funds (h) 9 175 $ 15 199

Total liabilities $ 376 $ 326 (e) $ 2 $ (81) $ 15 $ 638 $181 (f)

(a) Losses for assets are bracketed while losses for liabilities are not.

(b) PNC’s policy is to recognize transfers in and transfers out as of the end of the reporting period.

(c) The amount of the total gains or losses for the period included in earnings that is attributable to the change in unrealized gains or losses related to those assets and liabilities held at the

end of the reporting period.

(d) Includes swaps entered into in connection with sales of certain Visa Class B common shares.

(e) Net gains (realized and unrealized) included in earnings relating to Level 3 assets and liabilities were $261 million for 2014 compared with net gains (realized and unrealized) of $920

million for 2013. These amounts also included amortization and accretion of $146 million for 2014 compared with $217 million for 2013. The amortization and accretion amounts

were included in Interest income on the Consolidated Income Statement, and the remaining net gains/(losses) (realized and unrealized) were included in Noninterest income on the

Consolidated Income Statement.

(f) Net unrealized gains relating to those assets and liabilities held at the end of the reporting period were $204 million for 2014, compared with net unrealized gains of $607 million for

2013. These amounts were included in Noninterest income on the Consolidated Income Statement.

(g) Settlements relating to commercial MSRs of $552 million represent the fair value as of January 1, 2014 as a result of an irrevocable election to measure all classes of commercial

MSRs at fair value. Refer to Note 8 Goodwill and Other Intangible Assets for additional information on commercial MSRs.

(h) These line items were corrected for the year ended December 31, 2013 to include transferred loans over which PNC regained effective control and the related liabilities that are

recorded pursuant to ASC 860. This resulted in additional transfers into Level 3 of $15 million for both Loans and Other borrowed funds.

160 The PNC Financial Services Group, Inc. – Form 10-K